Between the confusion of PPF vs Mutual Fund, if your goal is to get better returns than Mutual fund is better over the term of 15 years. And if you are looking for safe investments, than PPF (Public Provident Fund) is better. If we consider 12% of expected return in mutual fund sip, than we get Rs. 3.78 Lakh extra returns in mutual funds compared to PPF.

Use PPF Calculator to know about your PPF Returns and SIP Calculator for Mutual Fund Returns.

Here we have considered the time horizon of 15 years since PPF has a lock in period of 15 years. For mutual funds, you can withdraw the money any time you want but generally long term of at least 5 years has to be considered to get good returns in some best mutual funds.

Let us check more details of PPF vs mutual funds with calculations of interest and returns below.

- PPF vs Mutual Fund Which is Better Video

- Features and Benefits of PPF

- Features and Benefits of Mutual Funds

- Best way to invest in Mutual Funds – SIP

- PPF vs Mutual Fund SIP Returns Comparison

- Is PPF better than Mutual Fund SIP?

- Is it worth investing in PPF now?

- At what age should I invest in PPF?

- What if I invest 1.5 lakh per year in PPF for 15 years?

- Conclusion

PPF vs Mutual Fund Which is Better Video

Watch more Videos on YouTube Channel

Features and Benefits of PPF

- PPF full form is Public Provident Fund. It is a government backed saving scheme with a lock in period of 15 years

- Which means once you open PPF account, you have to keep it active for next 15 years (16 financial years to be precise)

- Minimum amount to be deposited in PPF is Rs. 500 in FY to keep the account active

- Maximum amount that can be deposited in PPF is Rs. 1.5 Lacs in FY to get maximum interest

- You can open PPF account in any nationalized bank or post office

- Current interest rate in PPF is 7.1% per annum for January to March 2026 quarter

- Interest rates are reviewed every quarter by Government of India

- You get Tax Benefits in PPF under Section 80C

- Maximum Rs. 1.5 Lacs can be claimed as deduction in Section 80C after you deposit in PPF

- Also, the interest amounts and maturity amount earned in PPF are tax free

ALSO READ: Rs. 1000 PPF Calculation for 15 Years

Features and Benefits of Mutual Funds

- Mutual funds help us to invest in stocks of companies

- Every mutual fund has a fund manager who manages the mutual fund

- This fund manager decides which stocks to invest in to maximize our returns

- When we don’t have time to analyze several companies to choose from and invest in them, it is best to invest in mutual funds and let the fund manager do the work for us as they are professionals

- Mutual fund returns will be based on the returns and performance of these companies that the mutual fund invest in

- You can watch the Mutual Funds for Beginners series here to know more about Mutual funds

Above series of Mutual Funds for Beginners will help you know a lot about mutual funds as a beginner.

Best way to invest in Mutual Funds – SIP

Now what is the best way to invest in mutual funds?

Short answer is SIP – Systematic Investment Plan. SIP is the best way to invest in mutual funds as you deposit small amount every month directly in mutual fund to get the benefit of rupee cost averaging.

You can invest in mutual funds in 2 ways:

- Lumpsum Investment: When you invest corpus of amount in single time

- SIP Investment: You invest small amount periodically in mutual funds via SIP every month (similar to RD)

While lumpsum investing depends on the time of the market you are investing in. And since market are not predictable it is difficult to time the market and get maximum returns via lumpsum investing.

On the other hand, SIP will help you to invest in mutual funds regularly, which means you get more units of mutual funds when market goes down and less units when market goes up. So you take the advantage of market volatility which is called Rupee cost averaging.

ALSO READ: SIP Returns Calculation in Excel

PPF vs Mutual Fund SIP Returns Comparison

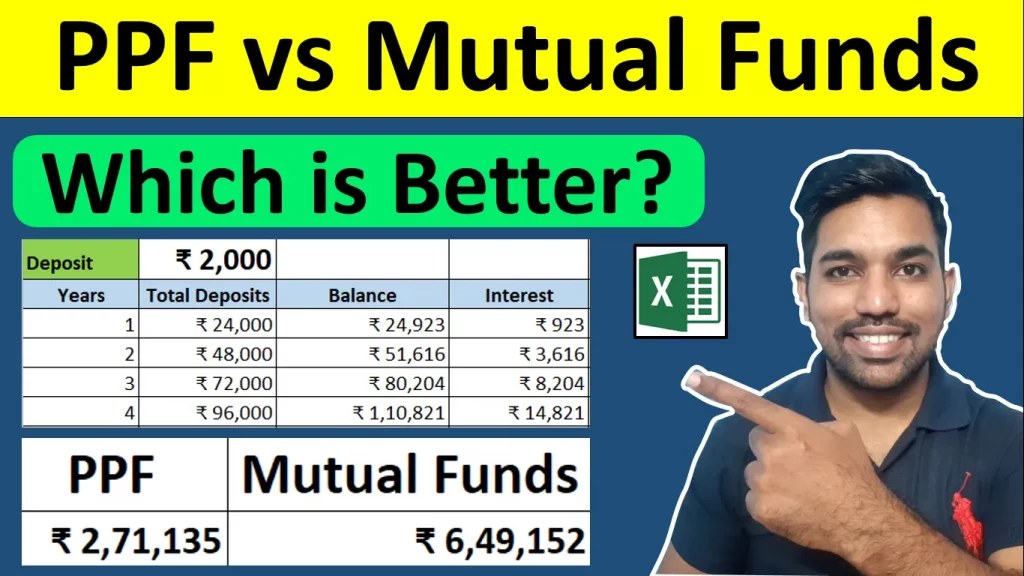

In the above video we have seen that Mutual fund SIP returns are 3.78 Lakh more compared to PPF interest if we deposit Rs. 2000 every month for next 15 years with interest rate of 7.1% in PPF (with compounding) and expected return of 12% every year in mutual funds via SIP.

Below is the table of data related to PPF vs Mutual Fund SIP Returns:

| Items | PPF | Mutual Funds SIP |

|---|---|---|

| Monthly Deposits | ₹ 2000 | ₹ 2000 |

| Tenure | 15 Years | 15 Years |

| Expected Returns (%) | 7.1% | 12% |

| Total Deposits | ₹ 3,60,000 | ₹ 3,60,000 |

| Maturity Amount | ₹ 6,31,135 | ₹ 10,09,152 |

| Profits | ₹ 2,71,135 | ₹ 6,49,152 |

| Taxation | Interest is not taxable | Profit is taxable |

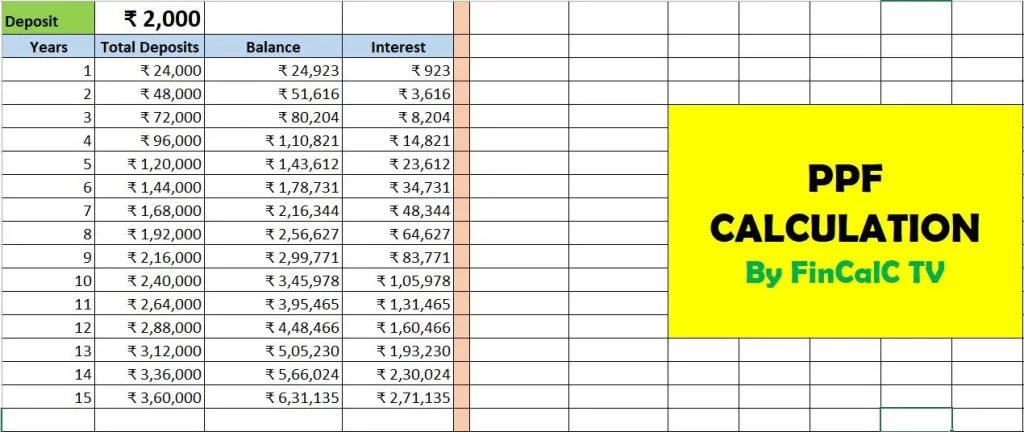

PPF Interest over 15 Years

Let us now see PPF Interest over 15 Years on Rs. 2000 monthly deposits

We get ₹ 2,71,135 as PPF interest in PPF account.

Let us now see Mutual Fund SIP Returns for same deposits and tenure.

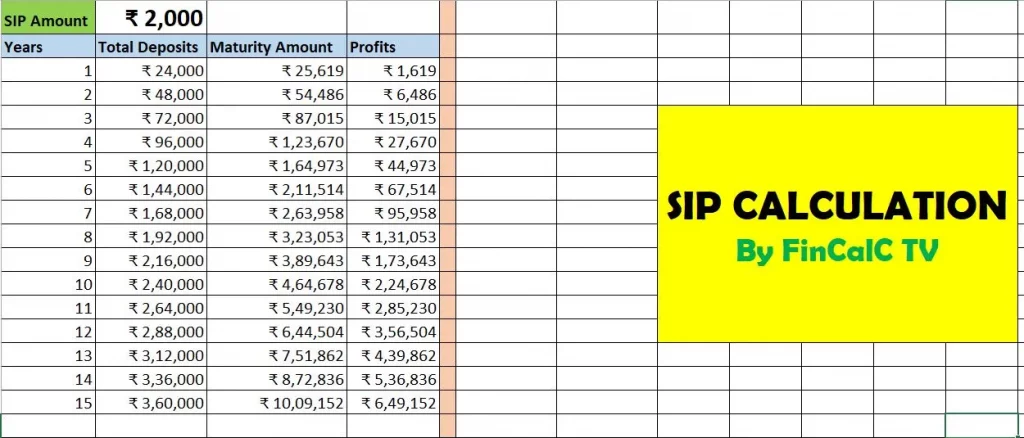

Mutual Fund SIP Returns over 15 Years

As seen above, we get ₹ 6,49,152 profits in mutual fund SIP for mentioned deposits and expected rate of return.

Please note that the returns are not guaranteed in mutual fund SIP. It depends on how market performs but over long term, good mutual funds have given better returns than PPF interest.

Also for PPF interest calculation, we have assumed 7.1% interest rate for 15 years for simplicity of calculations. Interest rates are reviewed by GOI every quarter and is subjected to be updated but it’s 7.1% from last 3 financial years!

Is PPF better than Mutual Fund SIP?

If you are looking for safe investments, PPF is better than SIP as far as security of your investment is concerned. But this does not mean that mutual funds SIP are not secured. Mutual funds are also secured as they are regulated by SEBI (Securities and Exchange Board of India).

Also we get compounding in PPF – which means we earn interest on already earned interest. In mutual funds we don’t get to see compounding, but the returns resonates with compounding. Read about Compounding in Mutual Funds SIP here.

But if you are looking for better returns, than mutual funds SIP is better than PPF. SIP has given better returns in the past any any slot of 15 years compared to PPF.

Is it worth investing in PPF now?

Even if the current interest rate is 7.1% for the quarter between January to March 2026, PPF is still an attractive investment option compared to other safe deposits.

If you are depositing Rs. 2000 every month with 7.1% interest rate with PPF compounding, you start getting more than Rs. 3500 as interest in PPF during the ending phase of 15 years tenure. This is more than your PPF deposits you are making, which is due to the compounding effect in PPF.

So PPF will always be a good option to invest in future as well. In fact you can also extend PPF account with a block of 5 years with or without deposits after 15 years.

At what age should I invest in PPF?

You become eligible to star saving in PPF by after 18 years of age. So it is better that you invest in PPF after your 18th birthday with the help of your pocket money or when you start earning.

You can also start PPF in late 30s or even 50s, it is never too late to invest in PPF.

What if I invest 1.5 lakh per year in PPF for 15 years?

You get maximum interest in PPF when you deposit Rs. 1.5 Lakh every year on or before 5th April.

Below is the table of interest you get when you invest 1.5 lakh per year in PPF for 15 years:

| Years | Total Deposits | Accumulated Interest | Balance |

|---|---|---|---|

| Year 1 | ₹ 1,50,000 | ₹ 10,650 | ₹ 1,60,650 |

| Year 2 | ₹ 3,00,000 | ₹ 32,706 | ₹ 3,32,706 |

| Year 3 | ₹ 4,50,000 | ₹ 66,978 | ₹ 5,16,978 |

| Year 4 | ₹ 6,00,000 | ₹ 1,14,333 | ₹ 7,14,333 |

| Year 5 | ₹ 7,50,000 | ₹ 1,75,701 | ₹ 9,25,701 |

| Year 6 | ₹ 9,00,000 | ₹ 2,52,076 | ₹ 11,52,076 |

| Year 7 | ₹ 10,50,000 | ₹ 3,44,523 | ₹ 13,94,523 |

| Year 8 | ₹ 12,00,000 | ₹ 4,54,184 | ₹ 16,54,184 |

| Year 9 | ₹ 13,50,000 | ₹ 5,82,281 | ₹ 19,32,281 |

| Year 10 | ₹ 15,00,000 | ₹ 7,30,123 | ₹ 22,30,123 |

| Year 11 | ₹ 16,50,000 | ₹ 8,99,112 | ₹ 25,49,112 |

| Year 12 | ₹ 18,00,000 | ₹ 10,90,749 | ₹ 28,90,749 |

| Year 13 | ₹ 19,50,000 | ₹ 13,06,642 | ₹ 32,56,642 |

| Year 14 | ₹ 21,00,000 | ₹ 15,48,514 | ₹ 36,48,514 |

| Year 15 | ₹ 22,50,000 | ₹ 18,18,208 | ₹ 40,68,208 |

Conclusion

So to conclude, below are the key take aways:

- Mutual fund is better than PPF if we consider returns over long term, with some risk

- PPF is a safe investment and is backed by Government so you can allocate some portion of investment allocation to PPF as well

- You can save income tax with PPF Deposits. ELSS Mutual Funds with 3 years lock in period also help you to save income tax under Section 80C

- PPF interest is tax free where as you pay tax on mutual fund investment

- Even after deducting tax on mutual fund profits, still returns would be better in mutual funds if you invest for long time horizon of 15 years in some good mutual funds

- For future returns, mutual fund is predicted to give Rs. 3.78 Lakh extra returns over next 15 years

- In past as well, mutual fund has given Rs. 5 Lakh+ returns as mentioned in video at the start of this post

If you are ready to take some risks, go for mutual funds or else PPF is better for you. For optimum returns, allocate your investment amount in both investments t reap benefits of both PPF and Mutual Funds.

Comment below what is your favorite investment option and why?

Some more Reading:

- Income Tax on SIP

- How to Save Income Tax on Salary above 7 Lakh

- How to Save Tax on Capital Gains

- Taxation on Short Term Capital Gains

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.