As a beginner if you want to invest in equities or stocks, mutual funds is the best option to start with. And when you want to invest in companies based on market capitalization, you should know Best Index Mutual Funds for 2023 that you can invest via SIP.

Index Mutual Funds are the type of Mutual funds that help you to invest in Indices such as Sensex, Nifty 50, Nifty Midcap, Nifty Smallcap, etc. These funds invests in equities based on the market capitalization of the companies. Some of the Best Index Mutual Funds for 2023 include – IDFC Nifty 50 Index Fund, Motilal Oswal Nifty Smallcap 250 Index Fund, DSP Nifty 50 Equal Weight Index Fund, Motilal Oswal Nifty Midcap 150 Index Fund, HDFC Index Fund Sensex Plan ranked in the descending order.

These are ranked based on their expense ratio, stocks in portfolio, fund manager experience, history and many other factors. Let’s see details of all these Index Mutual Funds one at a time.

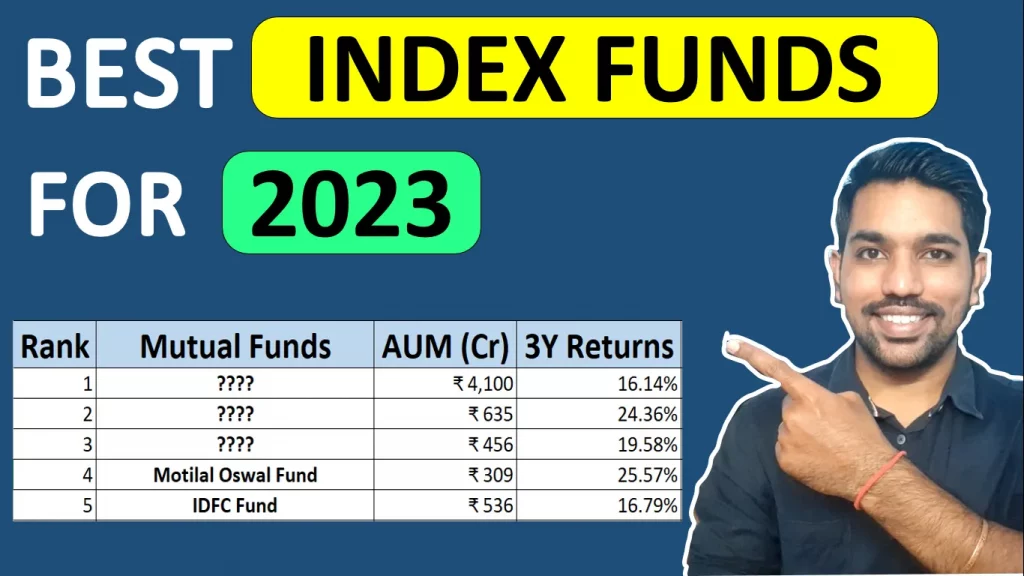

Below is the table of Best Index Mutual Funds for 2023:

| Rank | Mutual Funds | AUM (Cr) | Expense Ratio | 3 Year Returns |

|---|---|---|---|---|

| 1 | HDFC Index Fund Sensex Plan | ₹ 4,100 | 0.20% | 16.14% |

| 2 | Motilal Oswal Nifty Midcap 150 Index Fund | ₹ 635 | 0.22% | 24.36% |

| 3 | DSP Nifty 50 Equal Weight Index Fund | ₹ 456 | 0.40% | 19.58% |

| 4 | Motilal Oswal Nifty Smallcap 250 Index Fund | ₹ 309 | 0.31% | 25.57% |

| 5 | IDFC Nifty 50 Index Fund | ₹ 536 | 0.10% | 16.79% |

*Above Data is as of Nov 2022

Important factors about Index Mutual Funds

- Index Mutual Funds invest in stocks or equities based on market capitalization

- They have low expense ratio compared to other equity mutual funds

- These are passively managed compared to other active mutual funds

- If a company goes out of an index (Sensex or Nifty), than the stock from Index Mutual Fund also goes out and is replaced by another stock with better market cap.

- SIP is the best way to invest in Index Mutual Funds. Use this SIP Calculator to calculate your expected returns.

Best Index Mutual Funds for 2023 Video

Watch more Videos on YouTube Channel

As seen in above video, we have also shown AUM (in Cr.). Please note that these statistics are going to change with time as more people start investing in these Mutual Funds. Anyway, change is constant!

If you are new to investment in Mutual Funds and want to learn basics, I have started a Mutual Funds for Beginners Video Series on YouTube to help you understand the basics of mutual funds. You can check the videos!

Let us now see Top 5 Index mutual funds for 2023 in India that you can consider investing for your long term goals.

1. HDFC Index Fund Sensex Plan

- This fund belongs to Sensex Index. Which means it invest in Top 30 Companies

- Currently it has an Expense Ratio of 0.20%

- The total AUM (Asset Under Management) is Rs. 4,100 Cr

- The 3 year returns in this mutual fund is 16.14%

Who should invest?

Since this is a mutual fund that belongs to Sensex Index, it invests in top 30 companies in BSE (Bombay Stock Exchange) in India as far as market capitalization is concerned. So those who want to take less risk can have exposure of this mutual fund with a time horizon of at least 3 years to 5 years.

2. Motilal Oswal Nifty Midcap 150 Index Fund

- This fund belongs to Nifty Midcap Index. Which means companies ranked between 100-250 in NSE (National Stock Exchange)

- Currently it has an Expense Ratio of 0.22%

- The total AUM (Asset Under Management) is Rs. 635 Cr

- The 3 year returns in this mutual fund is 24.36%

Who should invest?

Since this is a midcap index mutual fund, it invests in companies ranked between 100 – 250 in India as far as market capitalization is concerned. So those who want to take moderate risk and get high returns can have exposure of this mutual fund with a time horizon of at least 5 years to 7 years.

ALSO READ: Rs. 1000 SIP Returns Calculation for 15 Years

3. DSP Nifty 50 Equal Weight Index Fund

- This fund belongs to Nifty Index. Which means Top 50 companies in NSE (National Stock Exchange)

- Equal Weight means all the stocks in the portfolio are given equal weightage – Almost same percentage of amount is invested in all 50 companies

- Currently it has an Expense Ratio of 0.40%

- The total AUM (Asset Under Management) is Rs. 456 Cr

- The 3 year returns in this mutual fund is 19.58%

Who should invest?

Since this is a large cap index mutual fund, it invests in top 50 companies in India as far as market capitalization is concerned. So those who want to take less risk can have exposure of this mutual fund with a time horizon of at least 3 years to 5 years.

4. Motilal Oswal Nifty Smallcap 250 Index Fund

- This fund belongs to Nifty Smallcap Index. Which means companies ranked between 250-500 in NSE (National Stock Exchange)

- Currently it has an Expense Ratio of 0.31%

- The total AUM (Asset Under Management) is Rs. 309 Cr

- The 3 year returns in this mutual fund is 25.57%

Who should invest?

Since this is a smallcap index mutual fund, it invests in companies ranked between 250 – 500 in India as far as market capitalization is concerned. So those who want to take high risk and expecting high returns can have exposure of this mutual fund with a time horizon of at least 5 years to 7 years.

ALSO READ: Rs. 2000 SIP vs Step up SIP Returns Comparison

5. IDFC Nifty 50 Index Fund

- This is another fund that belongs to Nifty Index. Which means Top 50 companies in NSE (National Stock Exchange)

- Currently it has an Expense Ratio of 0.10%

- The total AUM (Asset Under Management) is Rs. 536 Cr

- The 3 year returns in this mutual fund is 16.79%

Who should invest?

Since this is a large cap index mutual fund, it invests in top 50 companies in India in NSE (National Stock Exchange), as far as market capitalization is concerned. So those who want to take less risk can have exposure of this mutual fund with a time horizon of at least 3 years to 5 years.

Conclusion

So these were some of the best Index mutual funds that are expected to give better returns in 2023-24 and upcoming years. Remember that past returns does not guarantee future returns and you should invest in mutual funds based on your risk appetite.

All categories of mutual funds in the list covers the top 500 companies in India and thus helps you investing in these companies belonging to large cap, mid cap and small cap categories.

Also remember that SIP is the best way to invest in Mutual funds. You can use the SIP Calculator to calculate your returns in mutual funds:

You can also use this Step up SIP Calculator to calculate returns when you increase your SIP amount every year.

Some more Reading:

- How to Start Investing in Mutual Funds via SIP

- How to Calculate XIRR in Mutual Funds

- Short Term Capital Gains Taxation Examples

- Important Facts about Income Tax Calculation

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.