There may be many questions in your mind about EPF (Employee Provident Fund) such as, what is EPF, how is EPF calculated in excel, how EPF Calculator Excel works, how EPF interest is calculated on monthly basis, what is the interest rate and how frequently the interest rate changes in EPF. Don’t worry, we have got you covered on all these questions!

EPF stands for Employee Provident Fund helps you to accumulate funds for your retirement. You contribute 12% of your Basic Salary + DA amount every month and your employer also matches your contribution which makes this scheme attractive and beneficial. To be precise, out of employer’s 12% of Basic Salary + DA, 3.67% is contributed towards EPF and remaining 8.33% is contributed towards EPS (Employee Pension Scheme). Interest in your EPF account is credited every year with the help of latest interest rate.

Something you need to know about EPF (Employee Provident Fund) is, how EPF works, latest interest rate on EPF, eligibility to become EPF member in India, how to register for EPF, what are the benefits of EPF, how to calculate interest in EPF, how to access EPF passbook and check EPF balance, how to transfer EPF online, how EPF withdrawal works, all of which we are going to see in this post.

- EPF Interest Calculator in Excel Video

- What is EPF

- Interest Rate on EPF for FY 2023-24

- Eligibility to become EPF India Member

- How to Register for EPF

- Benefits of EPF India Scheme

- How to Calculate Interest in EPF

- How to access EPF Passbook

- How to Check EPF Balance

- How to Transfer EPF Online

- How to Activate Inoperative Accounts

- Under what circumstances can EPF be withdrawn

- What is the process of EPF withdrawal

- Download EPF Excel Calculator

- Frequently Asked Questions (FAQs)

EPF Interest Calculator in Excel Video

What is EPF

The Employees Provident Fund (EPF) is a savings scheme introduced under the Employees Provident Fund and Miscellaneous Act, 1952. It is administered and managed by the Central Board of Trustees that consists of representatives from three parties, namely, the government, the employers and the employees.

The Employees Provident Fund Organization (EPFO) assists this board in its activities. EPFO works under the direct jurisdiction of the government and is managed through the Ministry of Labor and Employment.

EPF scheme aims at promoting savings to be used post-retirement by various employees all over the country. Employees Provident Fund or EPF is a collection of funds contributed by the employer and their employee regularly on a monthly basis. The employer and employee contribute 12% each of the employee’s salary (basic + dearness allowance) to the EPF. These contributions earn a fixed level of interest set by the EPFO. The amount of interest to be received on the deposit along with the total accumulated amount is totally tax-free, i.e. the employee may withdraw the entire fund without worrying about paying any kind of tax on it, if total years of service is more than 5 years.

The accrued amount may also be withdrawn by the nominee or the legal heir of the employee post his death or can be withdrawn by the employee himself post-resignation.

Dearness Allowance: This amount is added to the employee’s basic salary due to rising. This allowance is different in different states. It is a relief given to employees to tackle ill-effects of inflation.

Use EPF online calculator to check total funds you will accumulate:

Also Read: NSC Interest Calculator [EXCEL VIDEO]

Interest Rate on EPF for FY 2023-24

The interest rate for the financial year 2023-2024 is 8.25%. The accumulated fund in the PF account attracts certain interest which is 100% tax exempted.

The interest earned is directly transferred to the Employees Provident Fund account and is calculated depending upon the rate which is pre-decided by the GOI along with the Central Board of Trustees (CBT).

The year in which the new interest rates are announced stays valid for the next financial year i.e. from the year starting on 1st April of one year to the year ending on 31st March of the next year.

Example

- The rate of interest i.e. 8.25% is valid and will be applicable only on EPF deposits made between the financial years of April 2023 to March 2024.

- The interest even though calculated on a monthly basis, is transferred to the Employees’ Provident Fund account only on a yearly basis on 31st March of the applicable financial year.

- The transferred interest is summed up with the next month i.e. April’s balance and is then again used for calculation of the interest.

- If the contribution is not made into an EPF account for thirty-six months continuously, the account becomes dormant or inoperative.

- Interest is offered on inoperative accounts of employees who have not attained the retirement age.

- Interest is not provided on the amount deposited in inoperative accounts of retired employees.

- The interest earned on inoperative accounts is taxable as per the member’s slab rate.

- For contributions made towards the Employees’ Pension Scheme by the employer, the employee shall not receive any interest. However, a pension is paid out of this amount after the age of 58.

ALSO READ: Rs. 2000 PPF Interest Calculation for 15 Years

Eligibility to become EPF India Member

- Employees need to become an active member of the scheme in order to avail benefits under this scheme

- Employees of an organization are directly eligible for availing Provident Fund, insurance benefits as well as pension benefits since the day they join the organization.

- Any organization employing a minimum of 20 workers is liable to give EPF benefits to the workers.

- This scheme does not cater to the needs of people residing in Jammu and Kashmir.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

How to Register for EPF

- Visit the government website Employee Provident Fund Organization (EPFO)

- Go to the section of ‘Establishment Registration’ that opens up a new page with ‘Instruction Manual’. It will explain the process of Employer Registration, followed by registration of DSC [Digital Signature Certificate] of the Employer which is a prerequisite for fresh application submission

- Accept “I have read the instruction manual” tick box to proceed and fill in the details to register

- An email e-link is sent which is to be activated and mobile PIN is also sent. You need to upload certain documents to register

- Those who are already registered can log in using their Universal Account Number (UAN)

Benefits of EPF India Scheme

The employees provident fund scheme extends an array of benefits towards the EPF employee members. It inculcates a sense of financial stability and security in them.

Here is a list of benefits that an EPF employee member can avail through the said scheme:

- Capital appreciation: The PF online scheme offers a pre-fixed interest on the deposit held with the EPF India. Additionally, rewards extended at maturity further ensure growth in the employees’ funds and accelerate capital appreciation.

- Corpus for Retirement: Around 8.33% of an employer’s contribution is directed towards the Employee Pension Scheme. In the long run, the sum deposited towards the employee provident fund helps to build a healthy retirement corpus. Such a corpus would extend a sense of financial security and independence to them after retirement.

- Emergency Corpus: Uncertainties are a part of life. Therefore, being financially prepared to face such unwarranted situations is the best an individual can do deal with exigencies. An EPF fund acts as an emergency corpus when an individual requires emergency funds.

- Tax-saving: Under Section 80C of the Indian Income Tax Act, employee’s contribution towards their PF account is deemed eligible for tax exemption. Moreover, earnings generated through EPF scheme are exempted from taxes. Such exemption can be availed up to a limit of Rs. 1.5 Lakh.

The tax benefits applicable to the Employees Provident Fund scheme ensure higher earnings to the members. It further improves savings and an individual’s purchasing power in the long-term. - Easy premature withdrawal: Members of EPF India are entitled to avail benefits of partial withdrawal. Individuals can withdraw funds from their PF account to meet their specific requirements like pursuing higher education, constructing a house, bearing wedding expenses or for availing medical treatment.

Also Read: PPF Interest Calculator for Next 30 Years [EXCEL VIDEO]

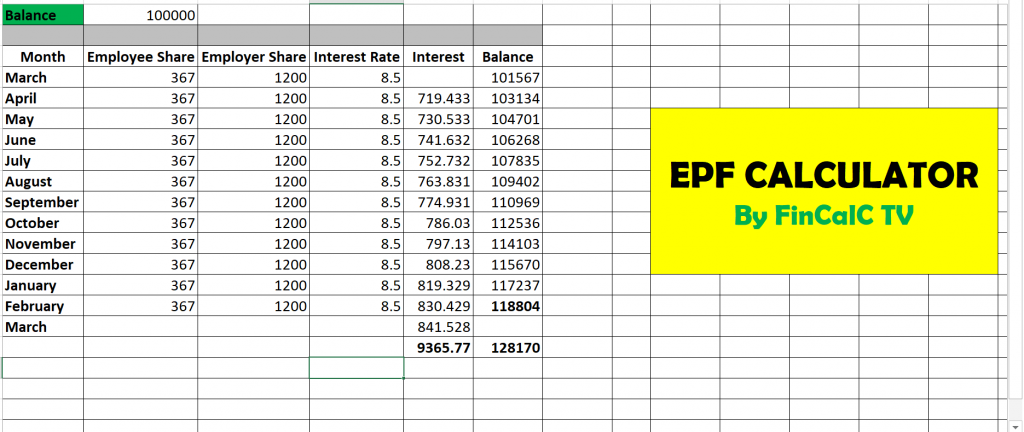

How to Calculate Interest in EPF

The interest extended on EPF schemes is calculated each month and is calculated by dividing the rate p.a. by 12.

Such a method helps to calculate the specific interest that is offered to member employees for a given month.

Example

If the rate of interest is 8.50% p.a. the rate for each month would be (8.50/12) %, i.e. 0.7083%.

Now, 12% of an individual’s salary is directed towards their EPF account.

Assuming that the salary of an individual is Rs. 15,000 per month:

12% of Rs. 15,000 would accrue Rs. 1800 by month-end which would be transferred to the individual’s EPF account.

Now, employers contribute 3.67% towards their EPF account, while 8.33% is contributed towards their EPS account.

The contribution towards EPF account would be 3.67% of Rs. 15,000 = Rs. 550 (Employer’s contribution)

The total contribution towards the EPF account would stand at Rs. (1800+550) = Rs.2350

The interest accrued in one month would be Rs. 2350 x 0.7083% = Rs. 16.64

It is to be noted that the interest accrued in a given month would only be credited to the account at the end of a current financial year.

Another important point to note is EPF compounding frequency is annual. This means you will get more interest on the interest gained in previous Financial years.

How to access EPF Passbook

All contributions made by a member and his employer are mentioned in the EPF passbook. The passbook also contains other important details such as establishment ID and name, member ID and name, office name, employee’s share, employer’s share, EPS contribution, etc.

The member can download the EPF passbook online by visiting the EPF website.

How to Check EPF Balance

A member can check the EPF balance accumulated in the account online by following these simple steps:

- Visit EPF website at www.epfindia.gov.in

- Go to “For Members” in the “Our Services” section

- Click on the “Member Passbook” option

- Now enter your “UAN”, password and captcha code and login to your EPF account

- Select the “Member ID” to view your passbook

- Your passbook will be displayed with complete details in the document.

- The member can also check his EPF balance by sending an SMS to 7738299899 in the format EPFOHO <UAN> ENG.

EPF balance can also be checked through a missed call on the number- 011-22901406.

Income Tax Calculation FY 2025-26 Video

How to Transfer EPF Online

- Log in to the EPFO members portal using your UAN and password

- A new dashboard displaying all your personal details will be shown. Verify all of that like DOB, EPF and date of joining, etc. so as to claim the process

- Once you verify, go to Step 1, select the option of previous or present employer and then provide the details of the previous employer through which you want to claim

- Submit the details, an OTP will be sent to your registered mobile number. You need to authenticate your identity by entering the OTP, then only the request will be submitted and an online filled-in form will be generated. You need to sign the form and send it to your present or previous employer

- The employer will also get an online notification about the EPF transfer request. EPFO Office will process the claim only after employer digitally forwards the claim to the EPFO after verifying your employment details

How to Activate Inoperative Accounts

Inoperative or dormant accounts are those which have not seen a contribution in over 36 months. Generally, it happens when a member has not transferred the old account to his new employer and tends to forget about the previous contributions. One can either transfer them to the current EPF account as per the above mentioned steps or withdraw them using UAN number.

Under what circumstances can EPF be withdrawn

Individuals may opt for either partial or complete withdrawal of EPF. But such withdrawals can be made only under specific circumstances.

Here is a list of a few such circumstances under which individuals can withdraw EPF completely:

- If their unemployment period extends more than two months.

- While switching from one profession to another or in between jobs. But the duration without a job should be more than two months.

Here is a list of a few such circumstances under which individuals can withdraw EPF partially:

- For a wedding.

- Higher education.

- Purchasing land or constructing a house.

- Repayment of home loan.

- Renovating a housing property.

ALSO READ: Home Loan EMI Prepayment [EXCEL VIDEO]

What is the process of EPF withdrawal

EPF India members can withdraw EPF by submitting a withdrawal application either offline or through EPF online portal.

Offline submission

Individuals need to fill up a ‘new composite claim form’ or a ‘composite claim form” and submit the same to the EPFO office under their jurisdiction. A composite claim form needs to be attested by their employer.

Online submission

- Individuals must have an active Universal Account Number (UAN).

- The mobile number used to activate the UAN should be active as well.

- UAN should be linked to be linked with Aadhaar. They would also need the PAN and respective bank details with its IFSC code.

- After ensuring all the prerequisites are in place, they need to login into the UAN online portal.

- Individuals need to verify their KYC details and then proceed as per instructions.

Being a retirement-oriented scheme, the primary aim of Employee Provident Fund is to enable individuals to become financially prepared for their retired life. This being said, individuals should try to avoid premature withdrawal if it is not necessary.

Download EPF Excel Calculator

You can download the EPF Excel Calculator using below button:

Frequently Asked Questions (FAQs)

1. I have withdrawn a part of my EPF corpus. Will I continue getting interest on the withdrawn amount as well?

Ans: No, You will not get interest on the withdrawn amount. However, the amount remaining in the EPF account will continue earning interest.

2. How is UAN assigned?

Ans. When you join a company having more than 20 employees, you become entitled to EPF benefits. EPFO allots a unique 12-digit permanent number known as Universal Account Number (UAN) to the member. All PF accounts of a member are linked with his UAN. In case you want to avail online services through the EPF portal, you have to link your UAN with Aadhaar and PAN.

3. Will I have to activate my UAN for transferring PF online?

Ans. You have to activate UAN by registering at the EPF member portal before you can process claims or withdraw funds online. You can do it easily by visiting the EPF member portal.

4. I have switched my job. Should I get a new UAN?

Ans. No, the UAN allotted to a member remains the same throughout the service period. A new PF account will be opened by the new employer which will be linked to the UAN of the member.

5. I have switched my company. Should I withdraw EPF corpus or transfer my fund?

Ans. It is recommended that you transfer your fund from the old PF account to a new one. If you withdraw the amount before 5 years of service, the withdrawn amount is taxable and should be mentioned under income from other sources while filing ITR.

6. I am currently unemployed and need funds. Can I withdraw my EPF corpus?

Ans. Yes, you can withdraw 75% of your EPF corpus after one month of unemployment. In case you remain unemployed for 2 consecutive months, you can withdraw the remaining 25% of the fund.

7. Is it still mandatory for members to link Aadhaar with EPF to avail online services? If not, is there a way to delink Aadhaar with UAN?

Ans. As per the recent circular released by the EPFO, UIADI has clarified that EPFO can continue to avail Aadhaar based authentication services for EPF schemes. So, in a way, you can not avail your EPF online services in case you delink your Aadhaar with UAN, as for now.

The circular also goes on to say that if a member visits the EPFO office for an offline claim using Aadhaar KYC, the PRO will facilitate Aadhaar seeding facility on the spot in order to make the EPF claim online.

Further, employees with their Aadhaar seeded with the UAN may not be allowed to raise offline claims from now on.

8. Are both the employee’s and employer’s contributions to my EPF account tax-exempt?

Ans. Contributions made to the EPF are tax exempt, however, the tax calculations are different. The employer’s contribution to the EPF account is not considered as part of your taxable income. So the employer’s contribution is tax-exempt at its source.

Whereas, the employee’s contribution is counted as part of his/her taxable income. However, the employee’s contribution is tax deductible under section 80C up to a maximum of Rs. 1.5 lakh per annum. So an employee’s contribution towards the EPF account is eligible to for tax-exemption but only under section 80C.

Also, in case you withdraw your EPF fund before 5 years of contributions, then both employee’s, as well as employer’s share, become taxable.

9. How much percentage is EPF deduction from salary?

Ans. 12% of the employee’s salary goes towards contribution to Provident Fund. Also, Employee State Insurance Corporation(ESIC) is deducted on gross salary which is 1.75% from the employee contribution & 4.75% from the employer contribution.

10. How much EPF amount can be withdrawn?

Ans. EPF can be withdrawn only at the time of retirement or in case of unemployment and certain emergencies. Full withdrawal can be done after retirement or unemployment for two months. As per the new rule, EPFO allows withdrawal of 75% of the EPF corpus after 1 month of unemployment. The remaining 25% can be transferred to a new EPF account after gaining new employment.

11. What If someone dies a natural death or due to health related issues. Will any of his/her family member get the EPF amount?

Ans. In case, if the EPF subscriber expires, the nominee or the legal heir or the guardian in case of a minor can get the EPF amount. For that he needs to go claim the EPF money by submitting all required documents like Death Certificate and EPF Composite Form. Guardian Certificate is also required if it is claimed by a guardian of a minor other than natural guardian.

12. How to withdraw Employee Provident Fund?

Ans. You need to have an activated UAN and registered mobile number for withdrawal. Assuming that you have these prerequisites, go to EPF Member’s Portal and login using UAN. Do check if your documents are verified as KYC in the ‘Manage’ section. Go to ‘Online Services’ and click on ‘Claim’ from the drop down menu which displays all your personal details. Then, click on ‘Proceed for Online Claim’ to claim your withdrawal and select the claim you want to make under ‘I want to apply for’ like EPF Settlement or EPF Partial Withdrawal.

13. How to claim Employee Provident Fund?

Ans. As explained above, one needs to go to EPF Member’s Portal or e-SEWA Portal to login using UAN and go to ‘Online Services’ to claim and withdraw the fund.

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.