Sukanya Samriddhi Yojana is for your girl child or sister below the age of 10 years. What happens when you consistently deposit Rs. 2000 per month in this scheme for her future? How much total amount with interest you can get? We will see Sukanya Samriddhi Yojana Interest Calculation in this article.

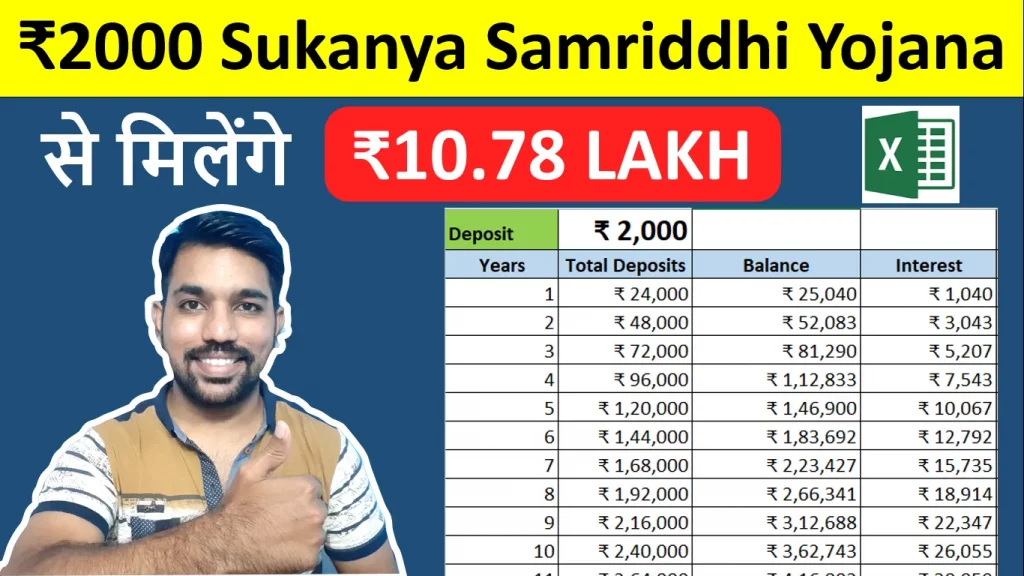

With Rs. 2000 per month deposits in Sukanya Samriddhi Yojana for next 15 years, after which there will be 6 years cooling period, the total amount you can get will be Rs. 10,78,895 at 8.2% interest rate consistently throughout the tenure. This amount includes the interest amount as well that is calculated every month and is compounded on yearly basis. You can open Sukanya Samriddhi Yojana account in post office.

- ₹2000 Sukanya Samriddhi Yojana Interest Calculation Video

- What is Sukanya Samriddhi Yojana plan?

- What is the benefit of Sukanya Samriddhi Yojana?

- What is Interest in Sukanya Samriddhi Yojana with 2000 per month?

- Which Yojana is best for girl child?

- How to get maximum interest in Sukanya Samriddhi Yojana?

- Conclusion

Watch below video to know the calculations for Rs. 2000 per month Sukanya Samriddhi Yojana Interest Calculation.

₹2000 Sukanya Samriddhi Yojana Interest Calculation Video

So as seen above, you get approximately Rs. 10.78 Lakh after SSY tenure end.

You can use the Sukanya Samriddhi Yojana calculator below to calculate your monthly interest:

Let us understand some features and benefits of Sukanya Samriddhi Yojana.

What is Sukanya Samriddhi Yojana plan?

- Sukanya Samriddhi Yojana (SSY) is a savings scheme launched back in 2015 as a part of Government initiative Beti Bachao, Beti Padhao campaign

- The current interest rate in Sukanya Samriddhi Yojana is 8.2% for quarter January to March 2026

- The interest rate is subjected to be reviewed by government of India every quarter, which might change in future

- If your girl child is below 10 years of age, you can open Sukanya Samriddhi Yojana account for her

- Maximum of 2 accounts can be opened for 2 girl childs

- Third account cannot be opened for third girl child

- Account is opened for total of 21 years or before girls marriage, whichever is lower

- You need to deposit for 15 years, next 6 years is considered as cooling period

You can accumulate good amount of funds for your daughter’s or sister’s higher education or marriage using Sukanya Samriddhi Yojana plan.

ALSO READ: Rs. 2000 PPF Interest Calculation

What is the benefit of Sukanya Samriddhi Yojana?

There are multiple benefits of investing in Sukanya Samriddhi Yojana Scheme:

- Sukanya Samriddhi Yojana Plan is a government backed scheme which means the interest amounts accumulated are guaranteed

- Attractive interest rate of 8.2%, that is fully exempt from tax under section 80C.

- Minimum Rs. 1000 can be invested in one financial year (April to March)

- Maximum investment of Rs. 1,50,000 can be made in one financial year (April to March)

- If the minimum amount of Rs 250/- is not deposited in any financial year, a penalty of Rs 50/- will be charged

- Deposits in an account can be made till completion of 15 years, from the date of opening of the account

- The account shall mature on completion of 21 years from the date of opening of the account, provided that where the marriage of the account holder takes place before completion of such period of 21 years, the operation of the account shall not be permitted beyond the date of her marriage

- Passbook will be issued to customers

- Withdrawal Facility

- To meet the financial requirements of the account holder for the purpose of higher education and marriage, account holder can avail partial withdrawal facility after attaining 18 years of age.

- If the beneficiary is married before maturity of account, account has to be closed.

- Monthly interest is calculated and compounding frequency is annual

- You can open a maximum of 2 accounts in a family

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

What is Interest in Sukanya Samriddhi Yojana with 2000 per month?

As mentioned above, you can get Rs. 10.78 Lakh total interest amount after 21 years tenure of Sukanya Samriddhi Yojana account.

Below are the details of every year interest calculation and accumulation:

| Years | Total Deposits | Balance | Yearly Interest |

|---|---|---|---|

| 1 | ₹ 24,000 | ₹ 25,040 | ₹ 1,040 |

| 2 | ₹ 48,000 | ₹ 52,083 | ₹ 3,043 |

| 3 | ₹ 72,000 | ₹ 81,290 | ₹ 5,207 |

| 4 | ₹ 96,000 | ₹ 1,12,833 | ₹ 7,543 |

| 5 | ₹ 1,20,000 | ₹ 1,46,900 | ₹ 10,067 |

| 6 | ₹ 1,44,000 | ₹ 1,83,692 | ₹ 12,792 |

| 7 | ₹ 1,68,000 | ₹ 2,23,427 | ₹ 15,735 |

| 8 | ₹ 1,92,000 | ₹ 2,66,341 | ₹ 18,914 |

| 9 | ₹ 2,16,000 | ₹ 3,12,688 | ₹ 22,347 |

| 10 | ₹ 2,40,000 | ₹ 3,62,743 | ₹ 26,055 |

| 11 | ₹ 2,64,000 | ₹ 4,16,802 | ₹ 30,059 |

| 12 | ₹ 2,88,000 | ₹ 4,75,186 | ₹ 34,384 |

| 13 | ₹ 3,12,000 | ₹ 5,38,241 | ₹ 39,055 |

| 14 | ₹ 3,36,000 | ₹ 6,06,340 | ₹ 44,099 |

| 15 | ₹ 3,60,000 | ₹ 6,79,887 | ₹ 49,547 |

| 16 | ₹ 0 | ₹ 7,34,278 | ₹ 54,391 |

| 17 | ₹ 0 | ₹ 7,93,020 | ₹ 58,742 |

| 18 | ₹ 0 | ₹ 8,56,462 | ₹ 63,442 |

| 19 | ₹ 0 | ₹ 9,24,979 | ₹ 68,517 |

| 20 | ₹ 0 | ₹ 9,98,977 | ₹ 73,998 |

| 21 | ₹ 0 | ₹ 10,78,895 | ₹ 79,918 |

Which Yojana is best for girl child?

Sukanya Samriddhi Yojana is one of the best schemes for girl child whether you have a daughter or young sister.

As seen above, it can give you good returns over a period of time.

ALSO READ: Rs. 1000 to Rs. 9000 Monthly Income from Post Office

How to get maximum interest in Sukanya Samriddhi Yojana?

Since you can deposit maximum of Rs. 1.5 Lakh in FY in Sukanya Samriddhi Yojana plan, you can deposit this maximum amount in April on or before 5th day.

This will help you to get maximum interest in this scheme over all the remaining months of the year. You can repeat this process for the next 15 years up to which you need to deposit in this scheme.

Conclusion

Sukanya Samriddhi Yojana can yield up to Rs. 10.78 Lakh as maturity amount over a period of 21 years. Also, you get the income tax benefits under Section 80C with this plan.

As compared to PPF which gives 7.1% currently, Sukanya Samriddhi Yojana gives 8.2% annual interest rate and is one of the attractive schemes to generate wealth for girl child over a period of time.

Some more Reading:

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.