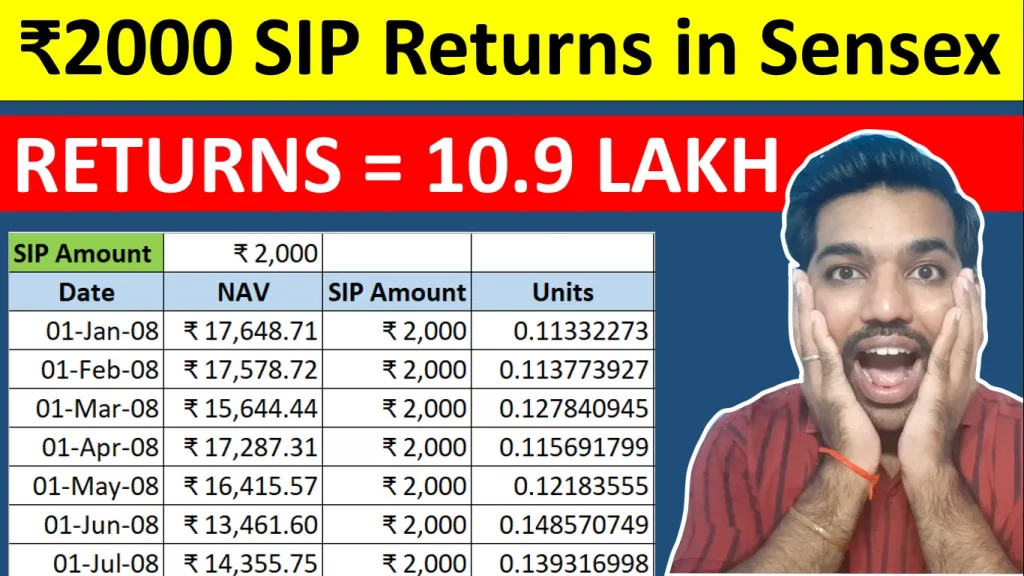

When we talk about Sensex Returns in Last 15 Years, it means how much returns we would have received if invested in top 30 companies on BSE (Bombay Stock Exchange). We have got annual average returns of 9.14% CAGR from Jan 2008 to Jan 2023 in Sensex for last 15 years. For Rs. 2000 of monthly deposits, the maturity amount would have been Rs. 10.9 Lakh with total deposits of Rs. 3.62 Lakh, which means a profit of 7.28 Lakh.

Let us understand Sensex Returns in Last 15 Years in detail with calculations.

₹2000 Sensex Returns in Last 15 Years Video

Watch more Videos on YouTube Channel

What is Sensex Index?

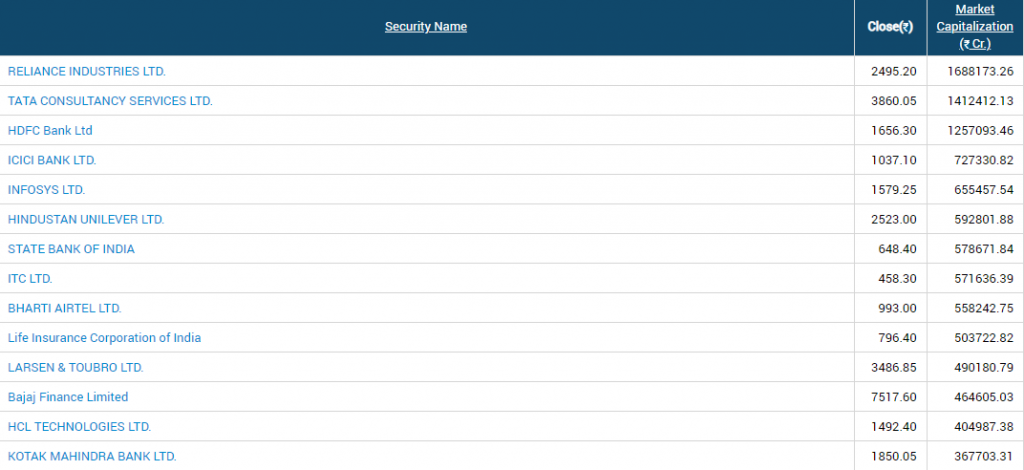

- Sensex Index in India represents that top 30 companies based on market cap on BSE (Bombay Stock Exchange) which is one of the oldest exchanges in India

- Usually these companies belong to Large Cap category and are well established and stable companies

- Companies in Sensex are less volatile in nature compared to other mid cap and small companies and have seen the ups and downs of the market for several years

- Sensex Index has given approximately 9.14% of CAGR (Compound Annual Growth Rate) in last 15 years on your investments. Which means, Rs. 2000 SIP per month in Sensex would have reached Rs. 10.90 Lakh in today’s date (Dec 2023)

Below are the top companies in Sensex Index taken from BSE Sensex:

ALSO READ: 8 Best Investment Options for Monthly Income

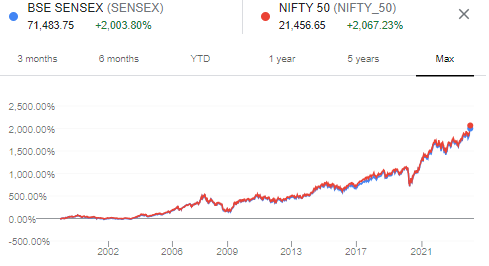

Difference between Sensex and Nifty

Sensex represents top 30 companies in BSE (Bombay Stock Exchange), where as Nifty represents top 50 companies based on market cap in NSE (National Stock Exchange), this is the only difference.

In Nifty 50, you get exposure to extra 20 companies in the list which are large cap, stable and well established companies.

Both Sensex and Nifty 50 have given almost same returns since last 25 years, and below is the chart depicting same:

It would have been better and will be better in future as well to consistently invest in one of these indices to get good returns over long period of time to achieve your financial goals, rather than buying and selling individual stocks if you are a new investor.

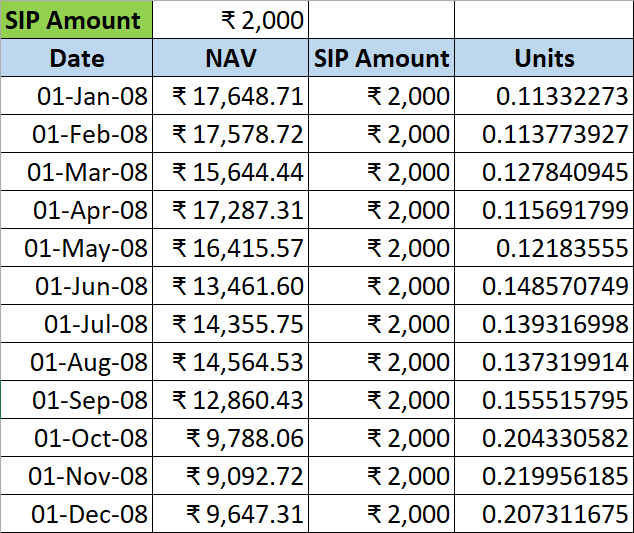

How to Calculate Sensex Returns in Last 15 Years?

Calculating Sensex Returns in Last 15 Years is quite simple, you can follow below steps:

- Go to investing.com website to access historical data of Sensex

- Select the date range for last 15 years to see the price of Sensex on monthly basis

- Copy these values and paste in an excel sheet

- Now since you have the price of Sensex for last 15 years on monthly basis, you can provide the SIP amount of your choice for every month

- Based on this SIP Amount, you can calculate the number of mutual fund units every month using below formula

Number of Mutual Fund Units = Amount / Price of Sensex- After getting number of units for all months in last 15 years, find the sum of all units you have accumulated so far

- Multiply this sum of units with latest price of Sensex to get the maturity amount after 15 years, which will be Sensex Returns in Last 15 Years based on the SIP amount provided by you

- The excel calculations will look something like this:

Watch the video at the top of this article to know more about all the steps mentioned above.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

What is the average return on Sensex?

Based on above calculations, the CAGR (Compound Annual Growth Rate) in Sensex for last 15 years is 9.14%, which is a good CAGR rate considering the ups and downs market have seen during 2008 recession and 2020 COVID 19 situation.

Since Sensex and Nifty includes well established companies, they are known to withstand all the ups and downs in the market compared to individual stocks of mid cap or small cap categories.

Sensex Mutual Funds Examples

Below are some of the examples of Sensex mutual funds that you can invest in with low expense ratio:

- HDFC Index Fund – Sensex Plan

- ICICI Pru S&P BSE Sensex Index Fund

- Nippon India Index Fund-S&P BSE Sensex Plan

- LIC MF S&P BSE Sensex Index Fund

- SBI S&P BSE Sensex Index Fund

While investing in any of the above mutual funds, make sure that you don’t invest in more than one mutual fund in above list and also opt for Direct Mutual funds in above funds. Direct mutual funds provides you better returns compared to regular version of same mutual fund due to low expense ratio.

Know the Difference between Direct vs Regular Mutual Funds here.

Conclusion

So Sensex returns is last 15 years was Rs. 10.9 Lakh on monthly SIP amount of Rs. 2000. Depending on the SIP amount, the total returns would have been different. Sensex grew at CAGR of 9.14% every year which is a good rate compared to other saving schemes in India.

Some more Reading:

- XIRR Returns via SIP in Mutual Funds

- Income Tax Calculation on Rs. 2000 SIP

- Mutual Funds for Beginners Videos

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.