In this post we will see Latest updated Post Office Interest Rates Table 2024 for the quarter between January to March 2024. These interest rates of small savings schemes from Post Office are reviewed on quarterly basis by the Government of India hence it is important to track the latest interest rates of all these small saving schemes.

The Post Office Interest rates for quarter January to March 2024 have been revised for few saving schemes and are as follows: Post Office Savings Deposit = 4%, Term Deposit or Fixed Deposits = 6.9% (1 year), Recurring Deposits = 6.7%, National Saving Certificate (NSC) = 7.7%, Post Office Monthly Income Scheme (MIS) = 7.4%, Public Provident Fund (PPF) = 7.1%, Senior Citizen Saving Scheme (SCSS) = 8.2%, Kisan Vikas Patra (KVP) = 7.5%, Sukanya Samriddhi Yojana (SSY) = 8.2%

Out of all above post office small saving schemes, Senior Citizen Saving Scheme provides the highest annual interest rate of 8.2%.

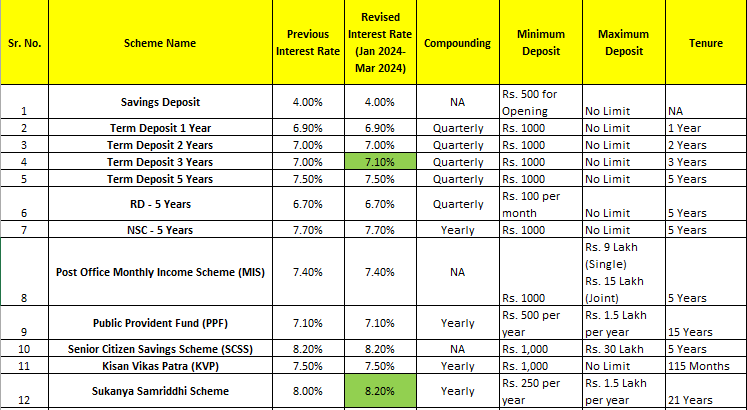

- Post Office Interest Rates Table – January to March 2024

- Savings Deposit – 4%

- Term Deposit – 7.5%

- Recurring Deposit – 6.7%

- National Savings Certificate (NSC) – 7.7%

- Post Office Monthly Income Scheme – 7.4%

- Public Provident Fund (PPF) – 7.1%

- Senior Citizens Saving Scheme – 8.2%

- Kisan Vikas Patra (KVP) – 7.5%

- Sukanya Samriddhi Yojana (SSY) – 8.2%

- Some more Videos

Post Office Interest Rates Table – January to March 2024

Below is the Post Office Interest Rates Table for quarter between January to March 2024:

Highlighted interest rates in green are the ones that are revised in this quarter.

The Interest rates seem to be attractive if you want low to negligible risks on your investments. These saving schemes can also be opened in popular banks (except few schemes) such as SBI, HDFC, ICICI, etc. with almost similar annual interest rates.

Let’s see benefits of all these Savings Schemes below.

Savings Deposit – 4%

- Savings Deposit (or Savings Account) is the most common type of deposit which almost everyone has

- This is the account in which mostly people keep their money in Post Offices and Banks and make most number of Transactions.

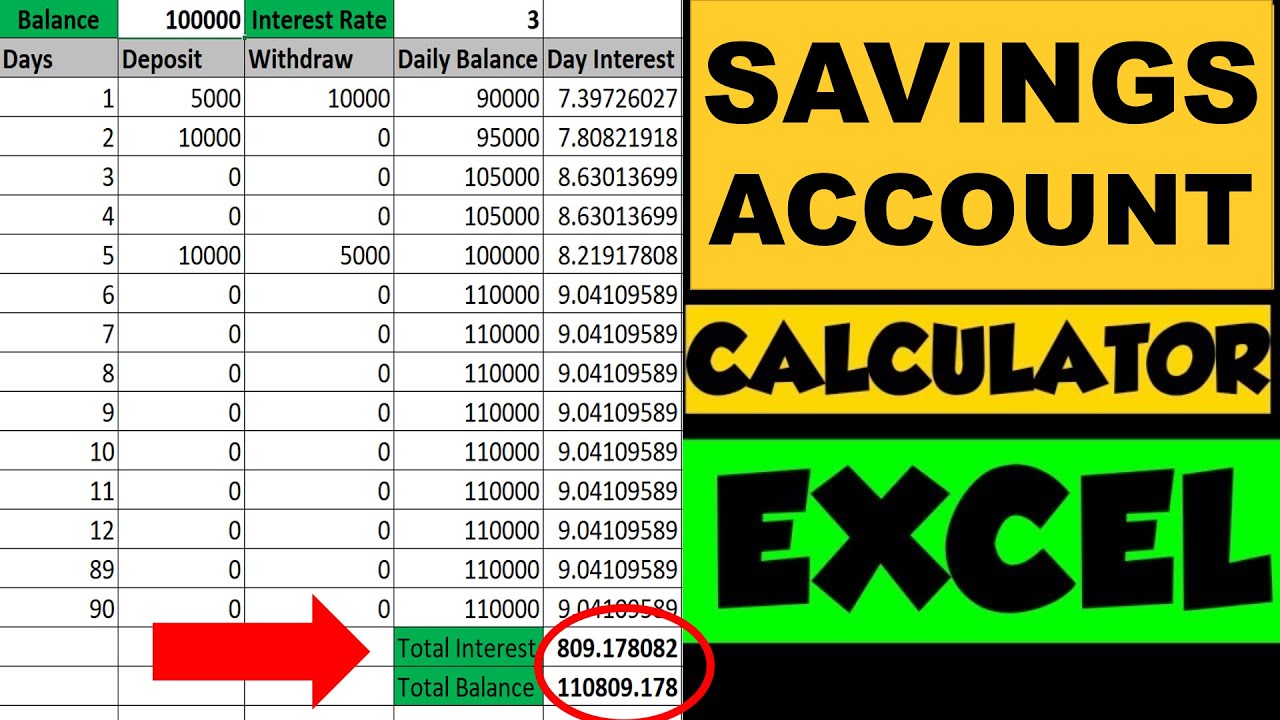

- The interest rate in this quarter is 4% in Post Office but it would be less in other banks as Banks

- Interest amount in Savings Deposit is calculated on Daily Lowest Balance and the amount is credited at the end of quarter

Savings Account Interest Calculation – Video

Term Deposit – 7.5%

- Term Deposit is also called as Fixed Deposit

- The Term Deposit or Fixed Deposit interest rates varies between 6.9% to 7.5% depending upon the tenure of Term Deposits

- You deposit a principal amount decided by you and you receive quarterly interest which is paid to you after FD maturity in case of cumulative FD, or your receive regular payouts in case of non-cumulative FD

- Fixed deposits have higher interest rates compared to Savings or Recurring Deposits interest rates

- Higher interest rates makes FD more attractive

- Irrespective of interest rates, the goal you are trying to achieve should be considered while opening of a Fixed Deposit

- If you have a lump sum amount that you need after 1 year, than Fixed deposit is the best place to keep your had earned money with some additional interests amount

Read more about Fixed Deposits here [VIDEO]

Recurring Deposit – 6.7%

- RD also called as Recurring Deposit is the type of account you open considering a goal in mind which are usually short term – 6 months to 2 years

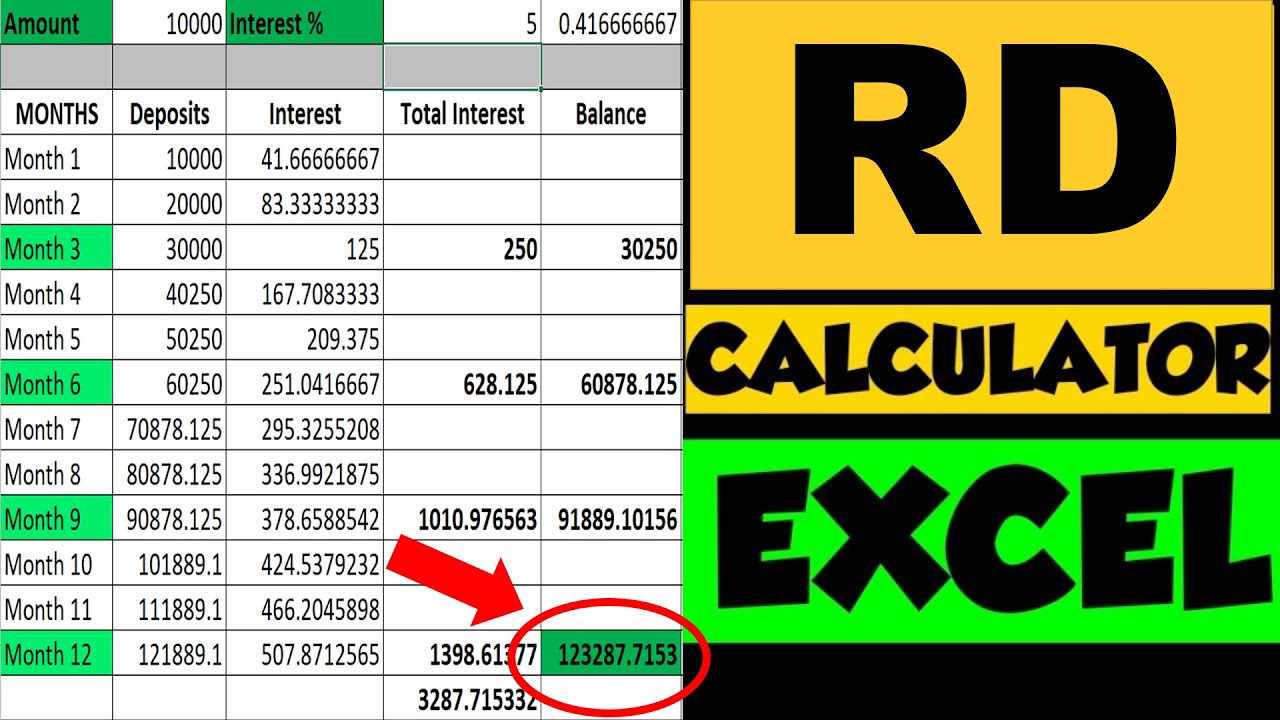

- The interest rate for 5 year recurring deposit is 6.7% in this quarter

- You regularly deposit in your recurring deposit account for a predefined period and accumulate sufficient amount to reach your goal

- While you deposit your money in recurring deposit, you get interest amounts based on the interest rate that is set during recurring deposit account opening

- The goals for opening an RD can be to pay for the next insurance premium, buying a new phone, etc.

- So instead of paying EMIs on such goals, you open recurring deposit account as a part of planning for your goal

- In this way, you accumulate sufficient amount to achieve the goal rather than buying things and paying later

- Another advantage of opening recurring deposit is that you earn additional interest instead of paying this additional interest which happens in paying the EMIs (in case your convert the buying amount to EMIs)

- The calculation of recurring deposit interest is similar to that of Fixed Deposit Interest Calculation. Compounding is done on quarterly basis in most of the banks

Read more about Recurring Deposits here [VIDEO]

National Savings Certificate (NSC) – 7.7%

- National Savings Certificate (NSC) scheme is a fixed income scheme.

- The current interest rate for National Saving Certificate (NSC) is 7.7% annually for 5 years NSC

- It is one of the popular savings instruments in India.

- One can activate this scheme at any Post Office.

- NSC scheme is the Government of India initiative. Hence it guarantees returns.

Read more about NSC here [VIDEO]

Post Office Monthly Income Scheme – 7.4%

- Maximum investment is Rs. 9 lacs in a single account and Rs. 15 lacs jointly.

- Current Interest rate for MIS is 7.4% annually.

- Account can be opened single, jointly, Minor (above 10 years of age) or a guardian on behalf of minor.

- Any number of accounts can be opened in any post office subject to maximum investment limit by adding balance in all accounts (Rs. 9 Lakh).

- Single account can be converted into Joint and Vice Versa.

- Maturity period is 5 years.

- Interest can be drawn through auto credit into savings account standing at same post office, or ECS. In case of MIS accounts standing at CBS Post offices, monthly interest can be credited into savings account standing at any CBS Post offices.

- Can be prematurely encashed after one year but before 3 years at the discount of 2% of the deposit and after 3 years at the discount of 1% of the deposit. (Discount means deduction from the deposit.).

- Interest shall be payable to the account holder on completion of a month from the date of deposit.

- If the interest payable every month is not claimed by the account holder such interest shall not earn any additional interest.

Post Office MIS Scheme Video

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

Public Provident Fund (PPF) – 7.1%

- PPF or Public Provident Fund is a savings scheme offered by the Government of India.

- PPF has a lock-in period of 15 years

- Minimum deposit amount in a FY to keep your PPF account active is Rs. 500

- Maximum deposit amount for which you can earn interest in PPF account is Rs. 1,50,000

- The interest on the account is paid by the government of India and is set every quarter, It is also tax-free.

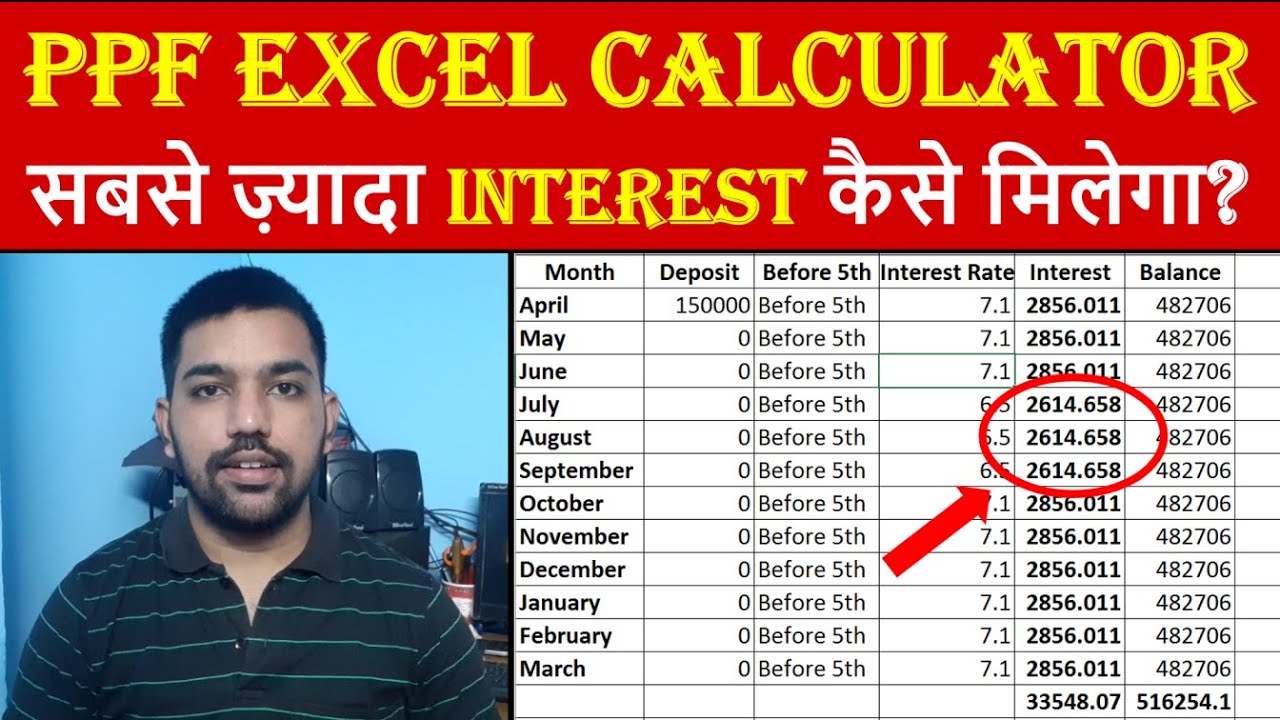

- PPF interest is calculated every month and is compounded annually

- The applicable PPF interest rate for January to March 2024, has been fixed at 7.1% annually.

- PPF or Public Provident Fund falls under EEE category (Exempt, Exempt, Exempt), which means, the Deposits, Interest and Maturity Amounts are all exempted from Income Tax

- Partial withdrawals are allowed in PPF account

- Loan facility is also available in PPF account

Read more about PPF here [VIDEO]

How to Maximize PPF Interest – Video:

Senior Citizens Saving Scheme – 8.2%

- Investing in SCSS is a good opportunity for senior citizens above 60 years to make money.

- Current Interest rate is 8.2% annually

- This is an effective and long-term saving option which offers security and added features that are usually associated with any government-sponsored savings or investment scheme.

- An individual can invest a maximum amount of Rs. 30 lakh, individually or jointly in an SCSS account (in multiples of Rs.1,000).

- The amount invested in the scheme cannot exceed the money that has been received on retirement.

- Hence, the individual can invest either Rs.15 lakh or the amount received as a retirement benefit, whichever is lower.

- The account can be opened by cash for an amount below Rs.1 lakh and by cheque for an amount exceeding Rs.1 lakh.

Read more about Senior Citizen Saving Scheme here [VIDEO]

Kisan Vikas Patra (KVP) – 7.5%

- Minimum Rs. 1,000 and in multiples of Rs. 100. There is no maximum limit.

- Account can be opened single, jointly, Minor (above 10 years of age) or a guardian on behalf of minor.

- The money will be double at maturity. However, as the interest rate changes on a quarterly basis. The maturity period also varies once in a quarter.

- The current Interest rate is 7.5% annually (will mature in 115 months).

Sukanya Samriddhi Yojana (SSY) – 8.2%

- Attractive interest rate of 8.0%, that is fully exempt from tax under section 80C.

- Minimum Rs. 1000 can be invested in one financial year (April to March)

- Maximum investment of Rs. 1,50,000 can be made in one financial year (April to March)

- If the minimum amount of Rs 250/- is not deposited in any financial year, a penalty of Rs 50/- will be charged

- Deposits in an account can be made till completion of 14 years, from the date of opening of the account

- The account shall mature on completion of 21 years from the date of opening of the account, provided that where the marriage of the account holder takes place before completion of such period of 21 years, the operation of the account shall not be permitted beyond the date of her marriage

- Passbook will be issued to customers

- Withdrawal Facility

- To meet the financial requirements of the account holder for the purpose of higher education and marriage, account holder can avail partial withdrawal facility after attaining 18 years of age.

- If the beneficiary is married before maturity of account, account has to be closed.

- Monthly interest is calculated and compounding frequency is annual

- You can open a maximum of 2 accounts in a family

Read more about Sukanya Samriddhi Yojana here [VIDEO]

Some more Videos

Some more Reading:

- Rs. 1000 PPF Interest Calculation

- Rs. 10,000 FD Interest Calculation for 10 Years

- Advantages of Tax Saving FD

- Deductions allowed for Tax Payers to Save Income Tax

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.