EPF Interest Calculation can be easily done with the help of the excel calculator and this we will check with the help of examples. Also we will check the EPF interest rate in 2024, based on which interest will be calculated in your EPF account.

EPF interest is calculated on monthly basis and yearly compounding happens in EPF (Employee Provident Fund) thus helping you to earn more interest in upcoming months and years. EPF interest rate for FY 2023-24 is set as 8.25%, which is reviewed every year by Government of India. Based on this annual interest rate, monthly interest rate is calculated, based on which you get monthly interest on the current balance in your EPF account.

Let us understand the EPF interest calculation steps or process in more details.

Watch below vide to understand EPF interest calculation:

EPF Interest Calculation & Interest Rate 2025 Video

Watch more Videos on YouTube Channel

As seen above, monthly interest is calculated in your EPF account and yearly compounding helps you to earn more interest in future.

What is EPF?

- EPF full form is Employee provident fund. EPF can be considered as one of the retirement schemes for you.

- 12% of Basic Salary + DA component is contributed from your salary every month towards EPF Contribution

- Same contribution is also done from employer side as well

- From employer contribution, 3.67% goes to EPF (Employee Provident Fund) and remaining 8.33% goes to EPS (Employee Pension Scheme)

- It is important to note that only EPF earns you interest amount. There is no interest earned from EPS account throughout the tenure.

- Know more about EPF and EPS differences here

EPF Contributions from Employee and Employer

- So basically, employee contributes 12% of Basic Salary + DA into his or her EPF account. This is the only contribution from employee side

- Employer also contributes 12% of Basic Salary + DA, which is divided as 3.67% in EPF and 8.33% in EPS (Employee Pension Scheme)

- Employee can increase the contribution based on his or her wish, but employer will only contribute maximum of 12% or Basic Salary + DA

- The contributions made by Employee can be claimed under Section 80C to save income tax

ALSO READ: Tax Saving options with Old Tax Regime

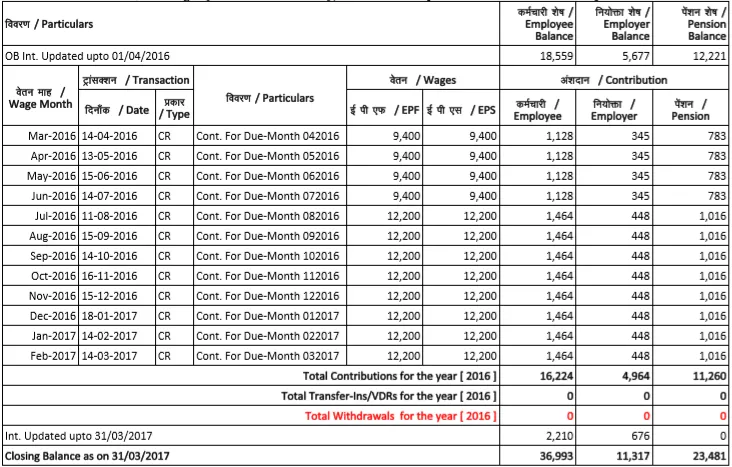

EPF Passbook Example

Below is the example of EPF passbook for s specific financial year along with the interest earned in that financial year:

This passbook example is used to calculate the interest mentioned in the video at the top of this article so make sure to watch that video to understand the EPF interest calculation with interest rate.

How is EPF interest calculated?

- As mentioned above, EPF interest is calculated every month based on the interest rate and the balance in your EPF account

- The interest of employee contribution and employer contribution to EPF is calculated separately

- EPS contributions do not provide us any interest amount as seen in above example

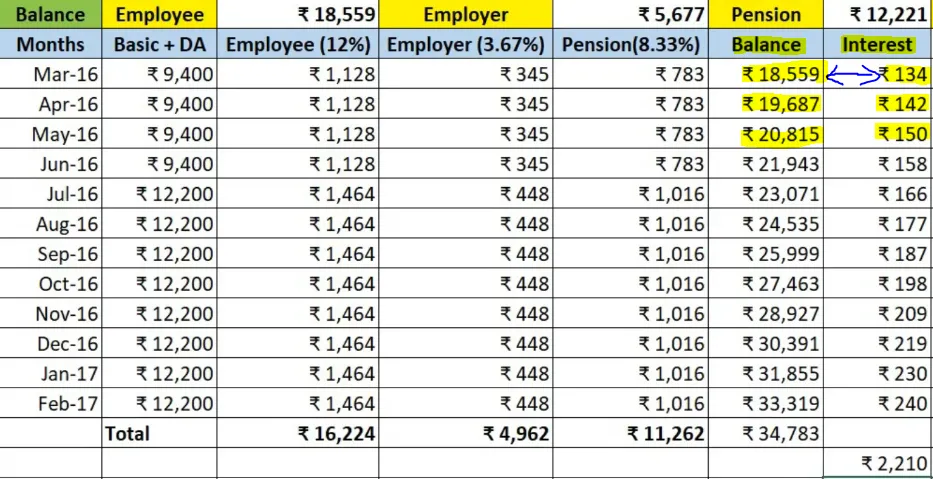

Below is the screenshot from EPF excel calculator to understand the EPF interest calculation:

So as seen above, let us consider the first row of calculations:

March 2016 is having balance of Rs. 18,559

Interest rate = 8.65%

Interest amount = Monthly Interest Rate * Balance / 100

Interest amount = (8.65% / 12) * Rs. 18,559 / 100

Interest amount = 0.72% * Rs. 18,559 / 100

Interest amount = Rs. 134In this way, the monthly interest is calculated every month based on the updated balance after the contributions are made in EPF.

At the end of financial year, on 31st March, interest amount from all months will be added to your balance to earn you more interest in upcoming months and years. This is yearly compounding in EPF.

Let us now talk about EPS or Employee Pension Scheme.

Download EPF Excel Calculator

You can download the EPF Excel Calculator using below button:

What is EPS in EPF?

- EPS full form of Employee pension scheme which is part of contributions that is made from employer side

- 8.33% of your Basic Salary + DA from employer side goes to EPS or employee pension scheme

- This contribution does not earn any interest amount throughout the tenure of your service

- It helps you to get pension after your retirement

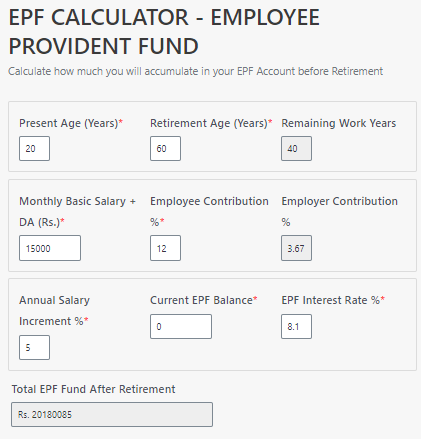

How to calculate PF maturity amount?

As seen above, you can calculate the interest every month after the contributions are made to know how much PF amount you can get after maturity.

Also you can use the EPF Calculator here to understand the PF maturity amount.

How to check PF interest amount?

You can easily check your current EPF balance and PF interest amount using the EPF Passbook service.

You need to provide the UAN number and password to check the contributions and PF interest amount in passbook for any year.

Watch video of Checking EPF and EPS Balance online Passbook

Conclusion

So as seen with examples and video above, EPF interest is calculated every month on current balance and latest interest rate. All the interest amount in financial year will be added to your balance on 31st March to earn you more interest amount in upcoming months and years.

Hence we get yearly compounding in EPF account. Where as, EPS (Employee Pension Scheme) does not earn any interest amount throughout the tenure

Some more Reading:

- Rs. 2000 SIP Returns Calculation for 15 Years

- Home Loan Part Payment Calculator

- PPF Interest Calculation for 15 Years

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.