Debt Mutual Funds Taxation is quite simple after the changes made in Budget 2023. From 1st April 2023, all redemptions from Debt Mutual Funds will be taxed as per the individual’s income tax brackets. So the short term and long term profits you make with Debt mutual funds will be added to your income and will be taxed based on the income tax slab rates. And if your income is within basic exemption limit of Rs. 2.5 lakh in a financial year, than no income tax need to be paid.

Let us understand Debt Mutual Funds Taxation in detail.

What are Debt Mutual Funds?

- Debt Mutual Funds are the type of mutual funds that invest at least 65% of total assets in debt instruments

- These Debt instruments include corporate bonds, government securities, commercial papers, treasury bills (T-Bills) and other money market instruments

- These funds are less risky in nature compared to equity mutual funds, because the main aim of these funds is to protect the capital of investor while providing steady interest rates over a period of time

- The funds are borrowed by companies or entities with a promise of pre decided interest rate

- The returns in Debt Funds can range between 6% to 10% based on the type of Fund selected

- The securities that the Debt Funds invest in has an associated credit rating. Higher the credit rating meaning the fund is less risky and on the other hand, if the fund invest in low rating securities than they are more risky in nature.

- So it is better to check the credit ratings of the instruments in debt funds to know about the risk factor of that fund

ALSO READ: Money Market Mutual Funds

Types of Debt Mutual Funds Tax

Previously before 1st April 2023, there were two types of tax on Debt mutual funds – Short term capital gains (STCG) and Long Term Capital Gains (LTCG), based on the holding period of 3 years. If funds were bought and sold within 3 years, than you make short term capital gains and if sold after holding period of 3 years than you make long term capital gains.

But in Budget 2023, it was announced that Debt Mutual Funds with at least 65% allocation of total assets in Debt instruments will not have short term or long term capital gains based on holding period, from 1st April 2023. Any profits made in Debt mutual funds will be added to income and taxed as per income tax slab rates of the individual irrespective of the holding period of Debt mutual fund.

| Period | STCG (Short Term Capital Gains) Tax | LTCG (Long Term Capital Gains) Tax |

|---|---|---|

| After 1st April 2023 | Slab Rate | Slab Rate |

| Up to 31st March 2023 | Slab Rate (Holding period less than 36 Months) | 20% with Indexation (Holding period more than 36 months) |

ALSO READ: Rs. 1000 Mutual Fund Returns Calculation

Long Term Capital Gains Tax on Debt Mutual Funds

After 1st April 2023, the profits you make as long term capital gains irrespective of the holding period of debt mutual fund will be taxed as per your slab rate and whether you choose Old or New Tax Regime.

Example

So for example, if you make profits of Rs. 50,000 in Debt Mutual Funds, below is the tax you need to pay excluding cess on this profit based on your income tax bracket:

| Income Tax Bracket (Old Regime) | Tax on Debt Mutual Fund Profits (Rs. 50,000) |

|---|---|

| Rs. 0 to Rs. 2.5 Lakh (0% Tax) | Rs. 0 |

| Rs. 2.5 Lakh to Rs. 5 Lakh (5% Tax) | Rs. 2,500 (Need to adjust with Tax Rebate 87A) |

| Rs. 5 Lakh to Rs. 10 Lakh (20% Tax) | Rs. 10,000 |

| Rs. 10 Lakh and above (30% Tax) | Rs. 15,000 |

So above are the tax you need to pay based on your income tax bracket on Rs. 50,000 of profits from Debt Mutual Funds irrespective of holding period.

Short Term Capital Gains Tax on Debt Mutual Funds

If you are selling your Debt mutual funds after 1st April 2023, short term capital gains will be added to your income and taxed accordingly, similar to long term capital gains mentioned above.

This means that short term and long term capital gains will be taxed in the same way after 1st April 2023.

ALSO READ: Equity Mutual Funds Taxation with Examples

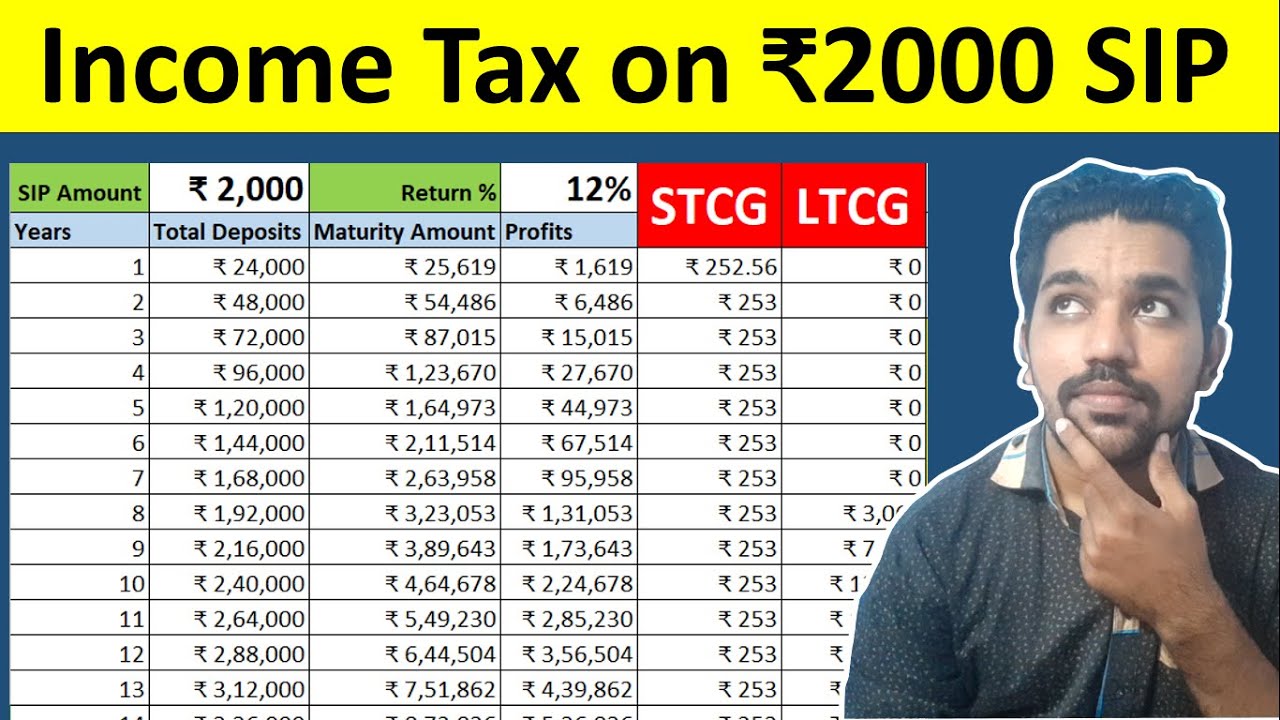

Income Tax on SIP in Equity Mutual Funds Video

Watch below video to understand income tax on SIP considering equity mutual funds as example:

Watch more Videos on YouTube Channel

Conclusion

So short term and long term capital gains will be taxed in same way as far as Debt Mutual Funds Taxation is concerned, after 1st April 2023. The profits made from Debt Mutual Funds will be added to your income and taxed as per income tax slab brackets.

Some more Reading:

- Good Amount of Term Insurance

- 6 Tax Saving Options using Old Tax Regime

- Rs. 2000 Sensex Returns in 15 Years [Video]

Frequently Asked Questions

How is debt mutual funds taxed?

The profits made in Debt mutual funds irrespective of the holding period, will be added to your total income and taxed as per income tax slab brackets. This change is done in Budget 2023 and will be applicable from 1st April 2023.

How to calculate tax on debt oriented mutual fund redemption?

Tax on debt mutual fund redemption is quite simple. You need to add the total profits made in debt mutual fund to your total income in financial year and calculate income tax based on your income tax bracket you belong to, based on your income investments.

What is the tax slab for debt?

Tax slab for debt mutual fund will depend on your income and the tax slab bracket you belong to in the financial year. The profits made in debt mutual funds will be added to your total income and will be taxed accordingly based on your choice of old or new tax regime.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.