Latest PPF Interest Rate is 7.1% for January to March 2026 quarter. Based on the balance in your PPF or Public Provident Fund Account, you get monthly interest and yearly compounding in PPF. This helps you to achieve you long term financial goals of 15 to 20 years. The highest interest rate in PPF was 12% during 1999-2000. Interestingly, you don’t have to pay any income tax on the maturity amount you get from PPF after 15 years. Also, the deposits you make in PPF account helps you to save income tax under Section 80C with Old Tax Regime.

- PPF Interest Rate History Table

- PPF Calculator

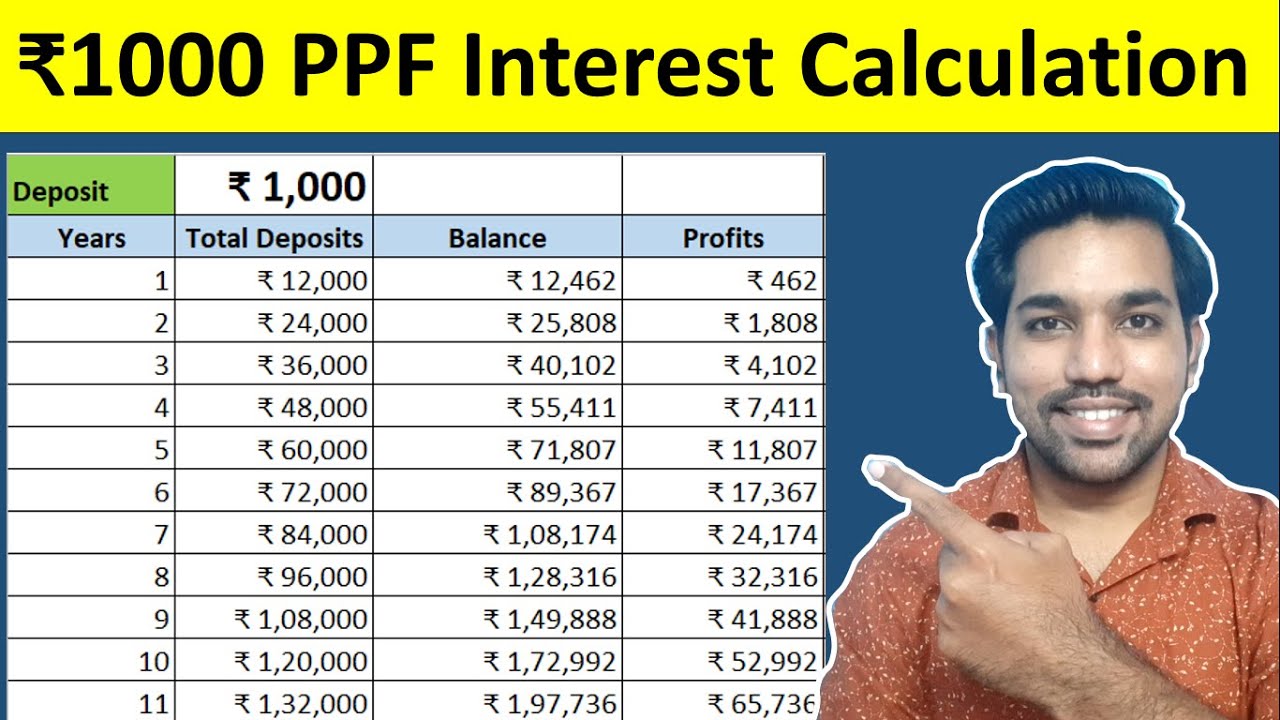

- Rs. 1000 PPF Interest Calculation Video

- Download PPF Excel Calculator

- What is the highest interest rate in PPF history?

- How much will I get after 15 years in PPF?

- Does the PPF interest rate change every year?

- Is PPF a good investment?

- Which is better, PPF or PF?

- Conclusion

Check below table on PPF Interest rate history to know more about how interest rates have been updated in PPF:

PPF Interest Rate History Table

| Year | PPF Interes1t Rate |

|---|---|

| 1st January 2026 – 31st March 2026 | 7.1% |

| 1st April 2020 – 31st December 2025 | 7.1% |

| 1st July 2019 – 31st March 2020 | 7.9% |

| 1st October 2018 – 31st June 2019 | 8.0% |

| 1st January 2018 – 30th September 2018 | 7.6% |

| 1st July 2017 – 31st December 2017 | 7.8% |

| 1st April 2017 – 30th June 2017 | 7.9% |

| 1st October 2016 – 31st March 2017 | 8.0% |

| 1st April 2016 – 30th September 2016 | 8.1% |

| 1st April 2013 – 31st March 2016 | 8.7% |

| 1st April 2012 – 31st March 2013 | 8.8% |

| 1st December 2011 – 31st March 2012 | 8.6% |

| 1st March 2003 – 30th November 2011 | 8.0% |

| 1st March 2002 – 28th February 2003 | 9.0% |

| 1st March 2001 – 28th February 2002 | 9.5% |

| 15th January 2000 – 28th February 2001 | 11.0% |

| 1st April 1999 – 14th January 2000 | 12.0% |

As seen in above table, the latest PPF interest rate 2026 is 7.1% for January to March 2026 quarter. The highest interest rate has been 12.0% in PPF during 1999-2000 financial year.

Note that the interest rates are reviewed by government of India every quarter and is set accordingly.

You can use below calculator to calculate PPF interest on your deposits

PPF Calculator

Below are few points to note about PPF interest calculation:

- Interest is calculated on monthly basis in PPF, based on the balance in the PPF account

- The month interest calculated is added in the balance at the end of financial year (31st March)

- This added interest in balance, helps you to earn more interest in upcoming months and years, throughout the 15 years tenure

Below is the example of PPF Interest Calculation

PPF Interest Calculation Example

Let’s say your PPF balance is Rs. 20,000 at the start of financial year. Which means, for the month of April, below is the interest calculation that will be done, if Rs. 20,000 was deposited before the 5th day of April:

PPF Monthly Interest = Monthly Interest Rate * Balance / 100

PPF Monthly Interest = (7.1% / 12) * Rs. 20,000 / 100

PPF Monthly Interest = (7.1% / 12) * Rs. 20,000 / 100

PPF Monthly Interest = Rs. 118So Rs. 118 will be the monthly interest for April month based on 7.1% interest rate. Similarly, interest will be calculated every month based on updated balance which depends on your deposits in PPF.

ALSO READ: Monthly vs Yearly deposits in PPF Which is Better?

Watch below video to understand PPF interest calculation on Rs. 1000 monthly deposits for 15 years

Rs. 1000 PPF Interest Calculation Video

Watch more Videos on YouTube Channel

Download PPF Excel Calculator

Click below button to download PPF calculator in excel for interest calculation:

What is the highest interest rate in PPF history?

The highest interest rate in PPF history is 12% during the 1999-2000 financial year. During that time, people had no idea about the benefits of PPF, where as the government of India was promoting PPF to raise funds. People who had opened PPF account during that time must have made enough profits to for retirement if they would have consistently deposited in their PPF account.

How much will I get after 15 years in PPF?

It depends on your deposits in PPF account. You can deposit maximum of Rs. 1.5 lakh in a financial year to get interest. This maximum amount can be deposited as lumpsum investment or as monthly deposits.

The lumpsum investment of 1.5 lakh during the start of financial year (before 5th April), will earn maximum interest in PPF Account. So if you deposit 1.5 lakh in April for 15 consecutive years, you would get maturity amount of around Rs. 40 lakh which means profit of Rs. 18 lakh. On other hand, if you make same deposit on monthly basis (Rs. 12,500 per month), you will get maturity amount of around Rs. 39 lakh.

Above calculations are based on 7.1% interest rate that we have assumed throughout 15 years, which is subjected to change in future.

WATCH: PPF Account Benefits & Interest Calculation

Does the PPF interest rate change every year?

PPF interest rate are reviewed every quarter by government of India. So the interest rate in PPF can change every quarter and not in every year. Frequency of change is on quarterly basis.

Is PPF a good investment?

Considering long term financial goals of 15 to 20 years, PPF or Public provided fund can be a good investment considering tax exemption under Section 80C and also the interest amount being non taxable as of now.

Below are some of the benefits of PF account which proves that PPF is a good investment:

- PPF interest is calculated every month and is compounded annually at the end of financial year

- PPF or Public Provident Fund falls under EEE category (Exempt, Exempt, Exempt), which means, the Deposits, Interest and Maturity Amounts are all exempted from Income Tax

- You can claim deduction with old tax regime under Section 80C that has maximum limit of Rs. 1.5 lakh in a financial year

- When you deposit on or before 5th day of the month, you get interest for that deposit within that month

- So if you are depositing lumpsum amount of Rs. 1.5 lakh in April, make sure you deposit the amount on or before 5th April, to get interest amounts from the month of April throughout the financial year

Which is better, PPF or PF?

PPF (Public Provident Fund) and PF (Employee Provident Fund) are two separate schemes for different financial goals. PF allows you to deduct 12% of basic salary every month that gets deposited in your PF account. Also the employer contributes same amount in your PF and EPS account. The drawback of PF is that, every month the amount will be deducted from your salary, but with PPF you have the option to decide when to deposit the amount voluntarily in a financial year.

Conclusion

So to summarize, PPF interest rates have been updated in the last 20 years and the highest interest rate has been 12% during 1999 to 2000 financial year. The current interest rate is lowest in the history of PF interest rate, since many people have started depositing in PPF accounts for tax saving purpose and other benefits mentioned above.

You you haven’t opened PPF account yet, you can easily open it in your current bank and deposit based on your long term financial goals. It is important to note that new tax regime will not allow PPF deposit deduction to save income tax as new tax regime does not allow maximum of the deductions for tax saving purpose. So if you want to open PPF account for tax saving purpose than you need to select old tax regime.

Some more Reading:

- PPF vs Mutual Funds Which is Better

- Interest Calculation in PPF for 15 Years

- Car Loan in India – What you Should know

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.