In this post we will see what is RBI Retail Direct Scheme, how to invest in RBI Bonds, how RBI Retail Direct Scheme works, whether you are eligible to invest in Government Securities, online portal link, Investment Markets for Bonds, Interest rates, Benefits and Risks of this Scheme

RBI Retail Direct Scheme was recently launched on 12th November 2021 by RBI in order to help people of India invest in Bonds and diversify their investments. Till date, a platform to aid in investing in bonds was missing. With the help of RBI Retail Direct Scheme, we will be able to invest in RBI bonds and Government Securities. The user is required to create a RDG Account – Retail Direct Gilt Account, that will hold and display the bonds allocated to the user. There will be no account opening charges or commission fee of any sought. User will be able to invest in bonds with the help of UPI or Internet Banking.

RBI Retail Direct Scheme Video

What is RBI Retail Direct Scheme

RBI Retail Direct Scheme allows retail investors to buy and sell government securities also called G-sec, online both in the primary and secondary markets. According to details provided by RBI, these small investors can now invest in G-Secs by opening a gilt securities account with the RBI. The account opened will be called Retail Direct Gilt (RDG) Account.

How to Open RDG Account

A retail investor can open the RDG account if they have following:

- Rupee savings bank account maintained in India

- PAN issued by the Income Tax Department

- Any official valid document such as Aadhaar, Voter ID for KYC purpose

- Valid Email ID

- Registered mobile number

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

RDG – Retail Direct Gilt Account Opening Process

Investors can register on the online portal by filling up the online form and use the OTP received on the registered mobile number and email ID to authenticate the information. Upon successful registration, ‘Retail Direct Gilt Account’ will be opened and details for accessing the online portal will be conveyed through SMS/e-mail.

RDG Account shall be available for primary market participation as well as secondary market transactions on NDS-OM.

Official link to open RDG Account: https://www.rbiretaildirect.org.in

Investment Markets for Bonds

Once the account is opened, retail investors can buy government securities in the primary market, where government bonds are issued for the first time or buy/sell the existing government bonds in the secondary market.

Registered investors can access the secondary market transaction link on the online portal to buy or sell government securities through NDS-OM.

User can use UPI or Internet Banking to complete the payments.

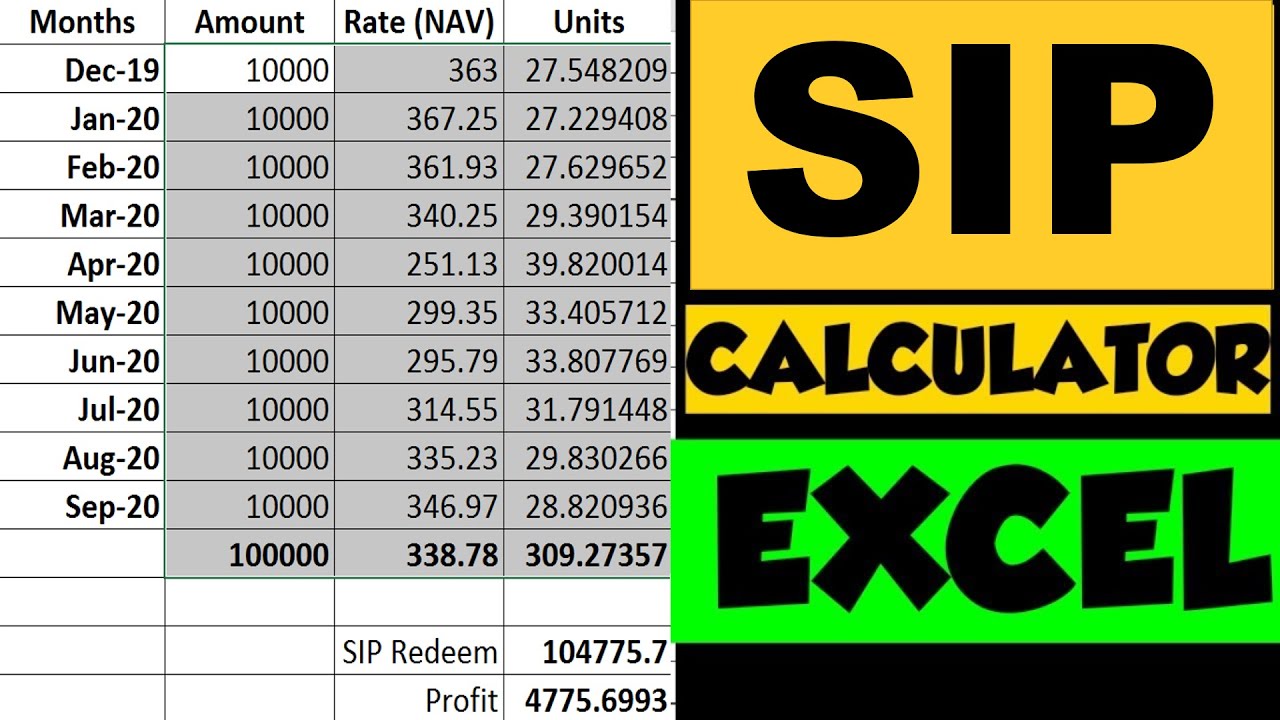

ALSO READ: SIP & Lump sum returns excel calculator [Mutual Funds]

Benefits of RBI Retail Direct Scheme

Below are some of the benefits of this Scheme:

- Diversification in your investment portfolio due to investment in bonds

- NRI can also invest un RBI Bonds

- No account opening charges

- No commissions on buying or selling bonds

- Good interest rates in the range 6.5% to 7%

- Online access of your account to buy and sell bonds

Charges of RDG Account

As per RBI, no fee will be charged for opening and maintaining RDG – Retail Direct Gilt Account. Further, no fee will be charged by the aggregator for submitting bids in the primary auctions. However, any payment gateway charges will be borne by the registered investor, as applicable.

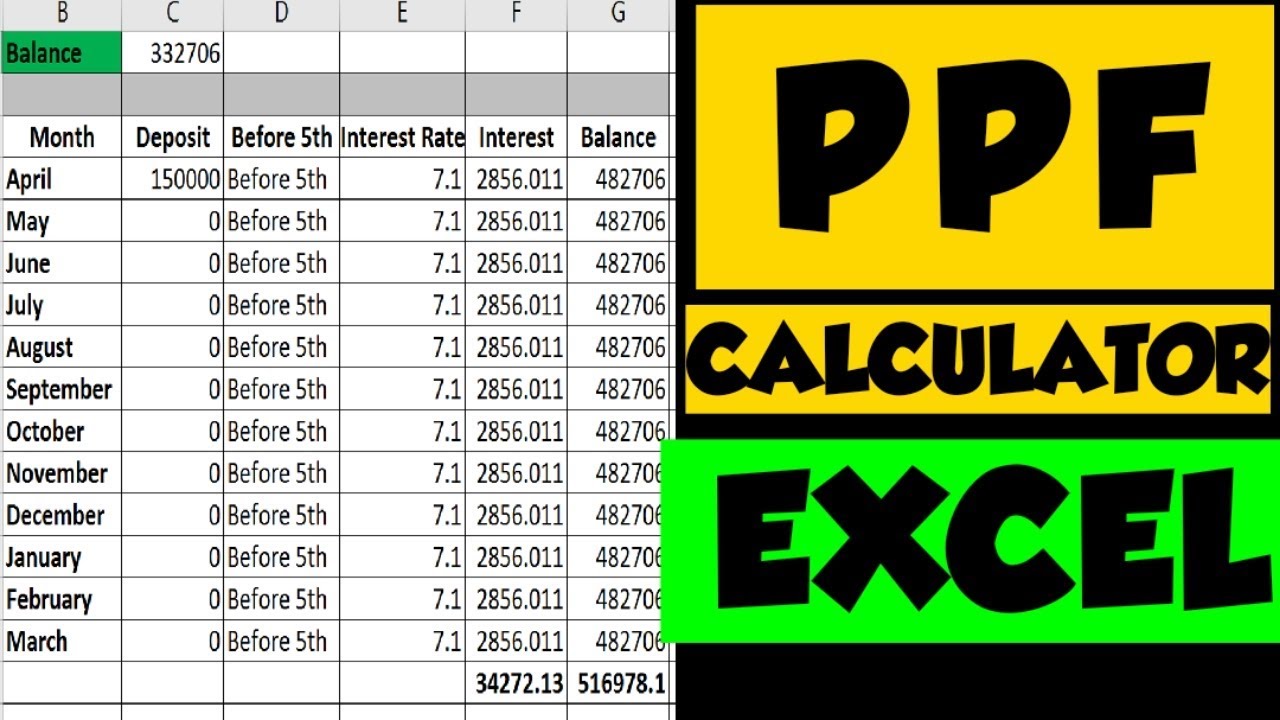

ALSO READ: Public Provident Fund Excel Calculator

Conclusion

With the introduction of RBI Retail Direct Scheme, it will be very easy for users to buy, hold and sell bonds. NRI can also invest in these schemes to get good interest rates compared to the rates in western countries. Also, you should have some portion of your investments in bonds to diversify your portfolio which makes this RBI Retail Direct Scheme attractive.

Some more Reading:

Some more Videos

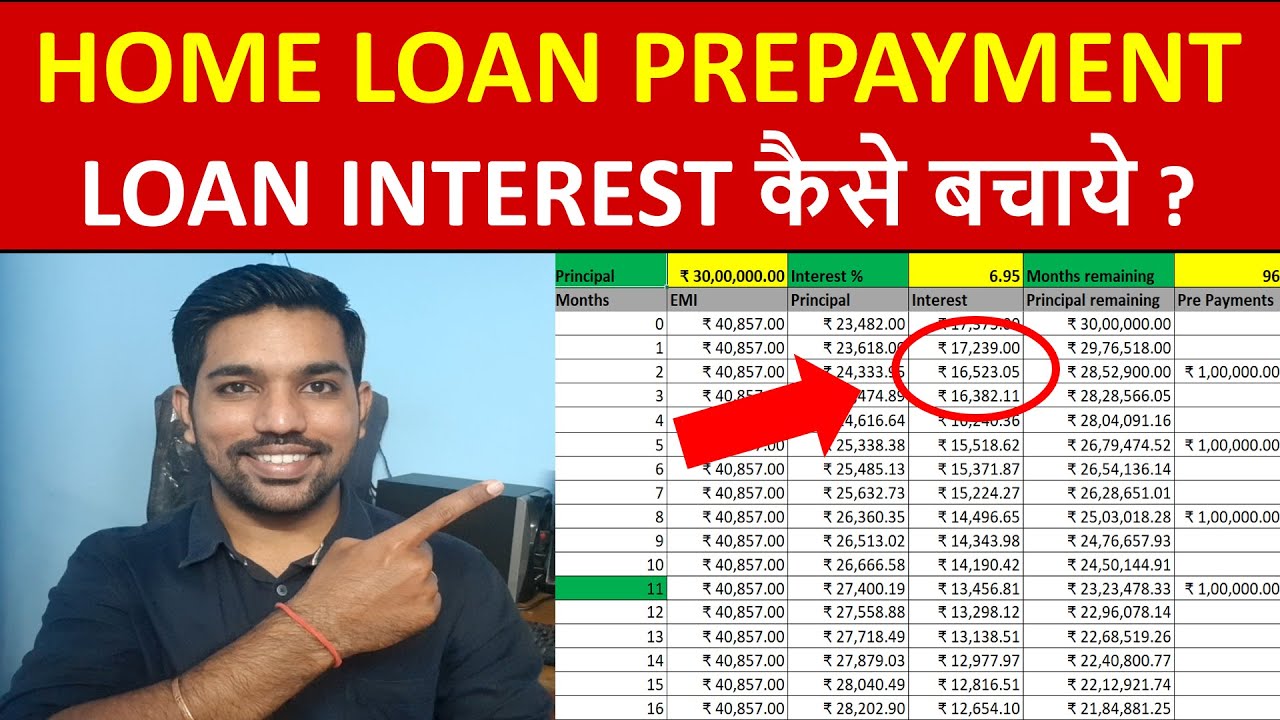

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.