This RD Calculator helps you to know how much interest you can get in Recurring Deposits. Every month amount is deducted and saved separately with high interest rate in RD.

You can achieve your short term goals of 6 months or 1 year tenure with RD like buying new smartphone and travelling to other countries. Latest Interest Rate in Post Office Recurring Deposit is 6.7% for January to March 2026 quarter.

Download Recurring Deposit EXCEL Calculator from here

Download our Android App FinCalC to see Slab-wise details of your Income Tax Calculation

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Share this Free RD Calculator with your friends and family members and help them in RD Interest Calculation!

ALSO READ: Latest Post Office Interest Rates

- Download Recurring Deposit EXCEL Calculator from here

- Download our Android App FinCalC to see Slab-wise details of your Income Tax Calculation

- What is RD?

- Goals while opening RD Account

- Features of RD

- HOW RD Calculator WORKS

- RECURRING DEPOSIT INTEREST RATES

- HOW TO OPEN RECURRING DEPOSIT ACCOUNT

- RECURRING DEPOSIT INTEREST CALCULATION

What is RD?

RD or Recurring Deposit is one the popular saving options in India that will help you to accumulate some predefined amount with the help of regular savings in Recurring Deposit. You can easily open RD in your bank using Internet banking or in post office. RD is usually done to achieve short term goals with no risk involved. The maturity amount in RD is guaranteed hence there is no risk. Recurring Deposit Interest Calculator will help you to know the interest you’ll get in Recurring Deposit.

Watch below video to understand RD Interest Calculation:

Goals while opening RD Account

It is important to have goals in mind before opening a RD or Recurring Deposit. You can have below short term goals while booking an RD:

- To buy a new smartphone with budget around Rs. 10,000, you can open a RD of Rs. 2,000 for 6 months

Similarly, you can open RD for goals you feel are important for next 6 months of 1 year. This helps you accumulate funds gradually without any pressure of spending the current funds in one go instantly!

Features of RD

- RD also called as Recurring Deposit is the type of account you open considering a goal in mind which are usually short term – 6 months to 2 years

- You regularly deposit in your recurring deposit account for a predefined period and accumulate sufficient amount to reach your goal

- While you deposit your money in recurring deposit, you get interest amounts based on the interest rate that is set during recurring deposit account opening

- So instead of paying EMIs on such goals, you open recurring deposit account as a part of planning for your goal

- In this way, you accumulate sufficient amount to achieve the goal rather than buying things and paying later

- Another advantage of opening recurring deposit is that you earn additional interest instead of paying this additional interest which happens in paying the EMIs (in case your convert the buying amount to EMIs)

- The calculation of recurring deposit interest is similar to that of Fixed Deposit Interest Calculation. Compounding is done on quarterly basis in most of the banks

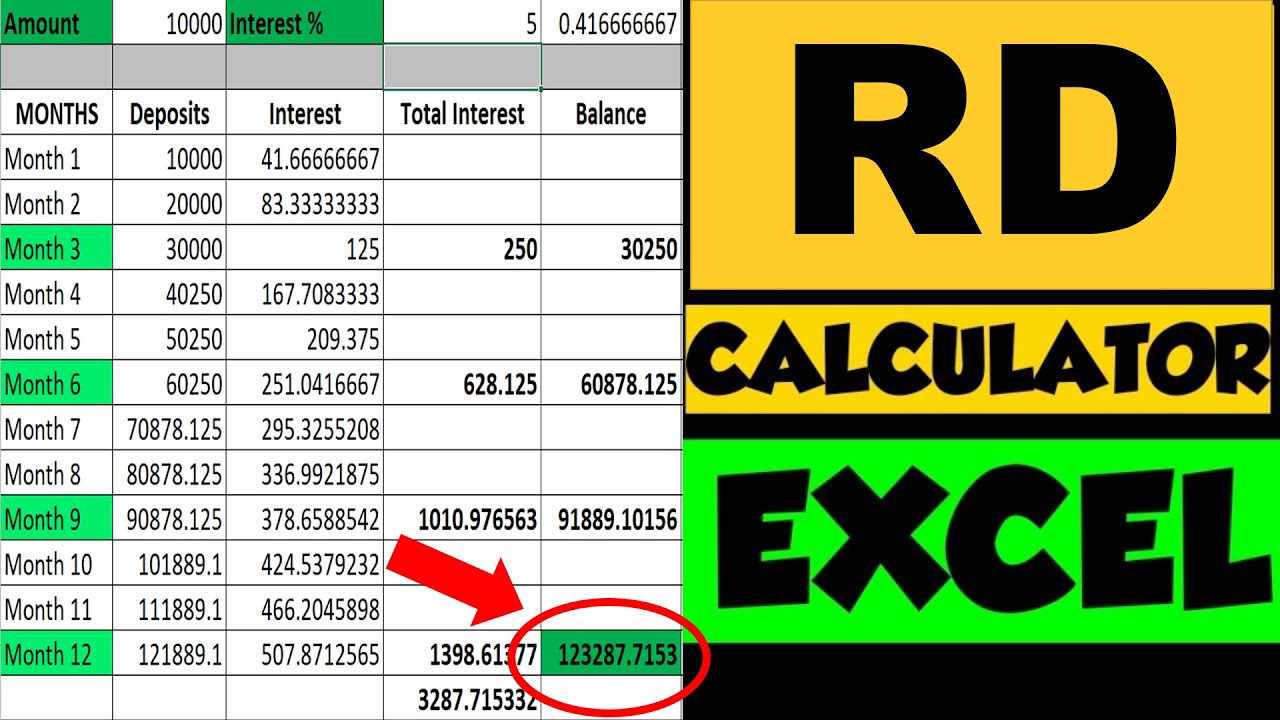

HOW RD Calculator WORKS

- As mentioned above, you deposit pre defined amount every month and accumulate the required amount to be achieved as your maturity amount in recurring deposit

- The maturity amount is the sum of all your deposits over the period of time and the additional interest you have earned

- In the process of interest calculation, compounding is done quarterly in which case, the already earned interest will earn you more interest in next quarters

- The interest is calculated on monthly basis based on the monthly interest rate derived from the annual interest rate, and this interest is than added to your balance every quarter. This is how compounding works in recurring deposit

RECURRING DEPOSIT INTEREST RATES

- Recurring Deposit interest rates ranges between 3.5% to 6.5% annually from bank to bank

- Interest rate also depends on the tenure you select

- For short periods (6 months to 12 months) – Interest rates are less, compared to the Interest rates for longer periods (1 year to 10 years)

- For senior citizens, interest rates are high by 0.25% to 0.5% compared to non senior citizens

- Getting good interest rates is another factor while opening a recurring deposit

- But more than thinking about recurring deposit interest rates, your aim should be to achieve the goal for which you open recurring deposit

HOW TO OPEN RECURRING DEPOSIT ACCOUNT

- You can easily open recurring deposit offline or online

- For offline mode, if you already have a bank account, you can open recurring deposit in that bank itself and give standing instructions to debit your account on a particular date with specific period

- You will be provided with hardcopy of recurring deposit certificate or a passbook

- For online mode, you can easily open recurring deposit via internet banking provided by the bank

- Popular banks such as SBI, HDFC, ICICI, Axis, etc. provide you this facility to open recurring deposit online via internet banking

RECURRING DEPOSIT INTEREST CALCULATION

Using RD Calculator, as mentioned above, recurring deposit maturity amount is the sum of all your deposits and the additional interest amounts you earn

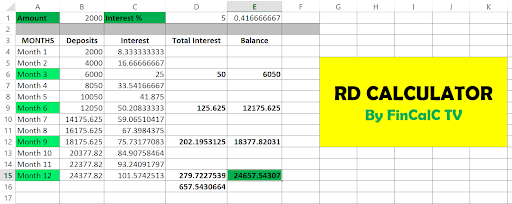

Example

Deposit = Rs. 2000

Interest rate = 5%

Tenure = 1 year

Below is the recurring deposit maturity amount:

As seen above, maturity amount for above example is Rs. 24,657

Few points to consider

- Interest rate was divided to monthly interest rate to calculate monthly interest on recurring deposit

- Compounding is done after every 3 months

- Entire Interest amount is added to the total principal amount to calculate recurring deposit maturity amount

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.