The decade of your 20s is one of the most crucial period of your life, not just for career development and personal growth, but for building a foundation of financial security that will define your future wealth. For most, this is the first time you earn an independent income, and the decisions you make now—even the small ones—will have an exponential impact on your financial standing by the time you reach retirement. Financial Planning for your 20s: Avoid Bad Debt, Live below your means, Start your SIP today, Invest aggressively and Avoid FDs except for emergency funds.

The core message is simple: Time is your single greatest asset in finance. Every year you delay your investment journey comes with a cost, robbing your future self of the incredible power of compounding. By following clear financial disciplines today—mastering debt, securing your health, and allocating capital intelligently—you can set a trajectory for lifelong financial freedom. The difference between starting at age 20 and age 30 is not merely 10 years; it is literally millions of rupees.

- The Compounding Advantage: Why Your 20s are the Golden Decade for Wealth Creation

- Prerequisites to Prosperity: Mastering Debt and Securing Your Future with Insurance

- The Frugal Fortress: Strategies for Optimal Savings and Beating Lifestyle Inflation

- The ₹1 Crore Blueprint: A Mathematical Look at the Power of Small, Consistent SIPs

- Strategic Asset Allocation: Building a High-Growth Investment Portfolio for Your 20s

- Why Equity Outperforms FDs, and the Smart Way to Own Gold

- Frequently Asked Questions

- Conclusion

The Compounding Advantage: Why Your 20s are the Golden Decade for Wealth Creation

The greatest mathematical tool in finance is compounding. Often referred to as “interest on interest,” compounding is the process where the returns you earn on your initial investment are reinvested, and those reinvested returns then earn their own returns. This process creates an accelerating snowball effect that grows your money over long period. In your 20s, you possess the longest possible investment horizon, making compounding your most powerful ally.

Understanding the Mechanics of Exponential Growth

To fully appreciate the urgency of starting early, one must understand the difference between linear growth and exponential growth. If an investment grows linearly, it increases by the same amount each year. Exponential growth, driven by compounding, means the growth rate itself accelerates because the base (the total value of your investment) is constantly increasing.

Consider two investors, both aiming for the same corpus at age 65:

- Investor A (The Early Starter): Starts at age 20 and invests for 45 years.

- Investor B (The Late Bloomer): Starts at age 35 and invests for 30 years.

Even if Investor B contributes significantly more capital annually, Investor A will almost always have a larger final corpus due to the Early Stage Compounding Effect. The early contributions have a disproportionately large impact because they have the maximum time to compound. The return on the return on the first ₹1,000 invested at age 20 will generate more wealth than the return on the last ₹10,000 invested at age 60.

This principle emphasizes the critical need to prioritize investing over consumption during this decade. The small amount you invest today is essentially a seed that will multiply exponentially, while the small expense you incur today (e.g., a frivolous gadget) is a cost that never compounds and provides no long-term benefit.

The Real Cost of Delay: Time as a Vanishing Asset

Delaying your investment by just a few years severely compromises your future wealth. This is mathematically quantifiable:

- 10-Year Delay: A 10-year delay typically requires you to double or triple your monthly contribution to achieve the same financial goal as the early starter.

- 20-Year Delay: A 20-year delay often makes the original goal virtually unattainable through monthly contributions, demanding enormous, unrealistic sums of capital later in life.

Your youth is a non-renewable resource in the world of finance. Once a year of compounding is lost, it cannot be regained, no matter how much money you contribute later. Therefore, the most essential financial advice for your 20s is to start now, regardless of the amount. Starting a Systematic Investment Plan (SIP) of even ₹500 today is a far superior decision to planning to start an SIP of ₹5,000 five years from now. The discipline of consistency, coupled with time, is the true engine of wealth.

Prerequisites to Prosperity: Mastering Debt and Securing Your Future with Insurance

Before capital can be deployed for growth, the financial foundation must be secure. This involves two non-negotiable pillars: managing debt and obtaining adequate insurance coverage.

The Cycle of High-Interest Debt

In your 20s, the temptation to take on debt is high, often driven by consumerism (fancy cars, the latest gadgets) or lifestyle pressures. However, high-interest debt is the single most destructive force to your ability to compound wealth. While an investment that earns 10% compounds in your favor, a loan with an 18% interest rate compounds against you.

Debts to Avoid and Eliminate Immediately (The Wealth Killers):

- Personal Loans: These are often unsecured, carrying very high interest rates (12-24%). They should be avoided at all costs.

- Credit Card Debt: With rates often exceeding 30-40% annually, revolving credit card debt is financial suicide. All credit card balances must be paid in full every month.

- Car Loans/Vehicle Loans: Purchasing a depreciating asset (a car or motorcycle) on an expensive loan is financially detrimental. The asset loses value while the loan generates negative compounding. The advice is clear: avoid car loans completely, or if absolutely necessary, minimize the loan amount and choose the shortest possible repayment tenure.

Acceptable Debt (The Good Loans):

- Education Loans: These are often strategic investments in your future earning potential. Since the return on human capital is often the highest possible return, an education loan at a moderate interest rate can be a worthwhile investment. Crucial rule: The loan must be taken in your own name, not your parents’, to instill financial responsibility and accountability.

- Home Loans (Later): While you should not buy a house too early in your life due to the inflexibility it imposes, a home loan later in your career (30s onwards) is generally considered “good debt” due to tax benefits and the long-term appreciation potential of the asset.

The Golden Rule: Pay off all existing high-interest debt before starting any investment. Your guaranteed, risk-free return is the interest rate you save by paying off the loan. If your credit card charges 36%, paying it off is equivalent to an investment yielding a tax-free, risk-free 36%—a return impossible to achieve elsewhere.

The Non-Negotiable Factor: Mandatory Insurance Coverage

Insurance is not an investment; it is a defensive shield that protects your wealth-building journey from catastrophic derailment. You need two types of insurance: life and health.

1. Term Life Insurance (Protecting Earning Potential)

Term insurance is the purest and most essential form of life insurance. It provides a large lump sum to your dependents if you pass away during the policy term.

- The Coverage Rule: Your cover amount should be 20 to 25 times your annual salary. For an individual earning ₹5 lakh annually, a cover of ₹1 crore to ₹1.25 crore is recommended. This amount ensures your family is financially secure and can replace your lost income for decades.

2. Health Insurance (Protecting Capital)

Health insurance is critical to prevent a sudden medical emergency from wiping out your savings or forcing you into debt.

- The Minimum Coverage: Aim for a minimum health cover of ₹10 lakh per person (or ₹10 lakh as a family floater). While your employer may provide a corporate health plan, it is often insufficient and ceases the moment you change jobs. A personal health plan guarantees continuous coverage.

- The Rationale: Hospitalization costs, especially in metropolitan areas, can easily exceed ₹5 lakh for a serious illness. Without adequate health insurance, you are forced to liquidate your investments or take out a high-interest personal loan, destroying years of disciplined financial effort.

Below is the summary of the insurance coverage you should be having:

| Insurance Type | Purpose | Coverage Recommendation | Age Advantage in the 20s |

| Term Life | Income Replacement for Dependents | 20-25 times Annual Income | Extremely Low Premiums |

| Health (Mediclaim) | Protection Against Medical Costs | Minimum ₹10 Lakh per person/family floater | Better Premium Rates; Less Exclusionary Clauses |

The Frugal Fortress: Strategies for Optimal Savings and Beating Lifestyle Inflation

With your debt under control and your insurance shield in place, the focus shifts to maximizing the capital available for investment. Your 20s are the prime time to embrace a frugal mindset and establish a powerful saving habit.

The 20% Investment Mandate

You must invest at least 20% of your monthly in-hand income. This is a minimum threshold for building serious long-term wealth.

- Example: If your monthly in-hand income is ₹50,000, you must commit to a minimum monthly SIP of ₹10,000.

- The Frugal Fortress Mindset: If you find it challenging to invest 20%, it is a clear sign that your lifestyle expenses are too high. In your 20s, society places fewer expectations on your spending (no one expects a luxury car or a large house). This low-expectation window is your secret weapon. The mantra is to “live like a student” for as long as possible.

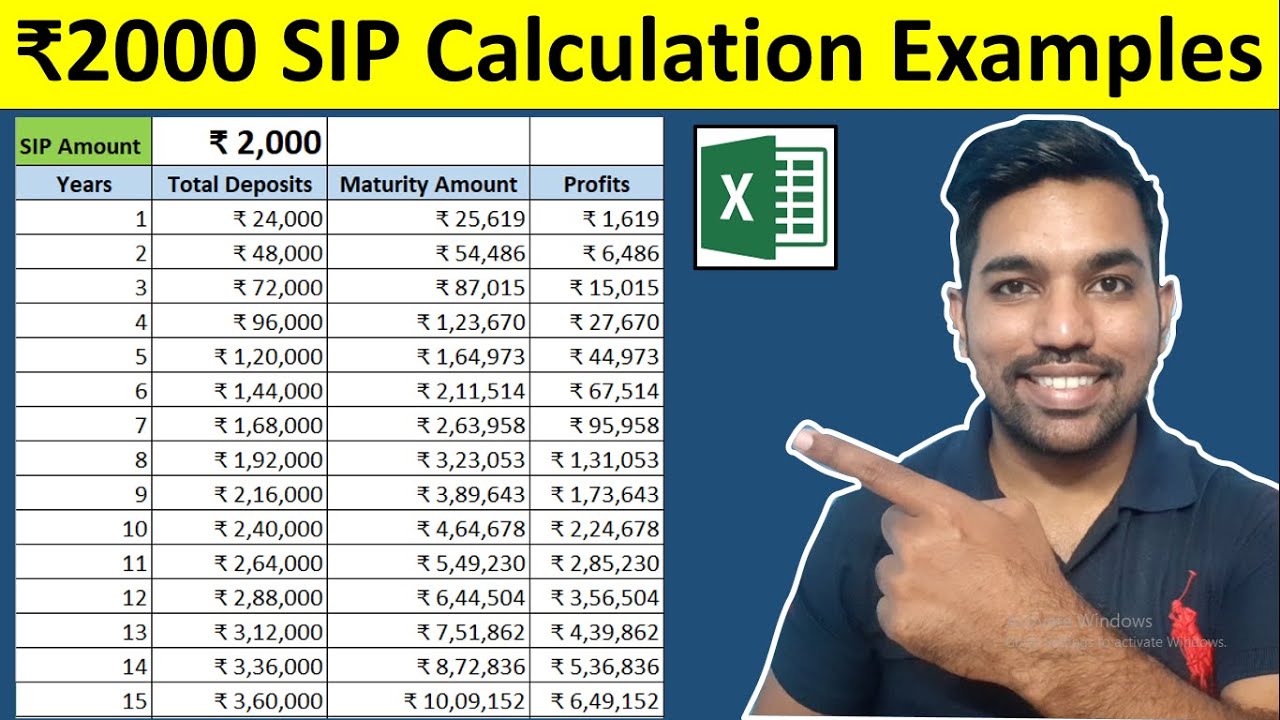

ALSO READ: Rs. 2000 SIP Returns for 15 Years

The Silent Killer: Lifestyle Inflation

Lifestyle inflation is the insidious phenomenon where your expenses increase proportionally (or sometimes more than proportionally) to your income increase. Every time you get a salary hike, you immediately upgrade your spending: a better phone, a more expensive apartment, costlier dining. This is the single biggest threat to financial freedom.

Tactics to Combat Lifestyle Inflation:

- The Delayed Gratification Rule: Delay major lifestyle upgrades. Can you keep using your current phone for one more year? Can you choose a more affordable rental for another 18 months?

- Pre-Commitment to Investing: Automate your investment (SIPs) to happen immediately on the day your salary is credited. This follows the principle: “Pay Yourself First.” What remains after investing is your budget for living expenses, not the other way around.

- The 50/30/20 Rule Adaptation: Adapt the classic budget rule:

- 50% for Needs (Rent, Utilities, Groceries)

- 30% for Wants (Entertainment, Dining, Travel)

- 20%+ for Saving and Investing (Mandatory minimum)

- In your 20s, push the “Wants” portion lower and divert the savings to the “Saving and Investing” portion, aiming for 30% or even 40% investment rate.

By maintaining a lean cost structure in your 20s, you maximize the early capital that benefits from compounding, giving you an insurmountable lead over peers who chose to inflate their lifestyle.

The ₹1 Crore Blueprint: A Mathematical Look at the Power of Small, Consistent SIPs

The most convincing argument for starting early comes from a simple, inflation-adjusted mathematical model.

The Financial Freedom Calculation

The goal is set: to retire at age 65 with a corpus of ₹1 Crore in today’s value. This means the final sum at age 65 must have the purchasing power of ₹1 Crore today, effectively accounting for inflation.

Assumptions Used in the Model:

| Variable | Value | Rationale |

| Starting Age | 20 years | Maximum compounding duration. |

| Retirement Age | 65 years | Standard long-term goal horizon. |

| Investment Duration | 45 years | The full power of time at work. |

| Assumed Annual Return | 10% | Achievable long-term return from a diversified equity portfolio. |

| Assumed Annual Inflation | 5% | Standard long-term inflation rate (required for inflation-adjusted goal). |

| Goal Corpus | ₹1 Crore (Today’s Value) | A substantial, meaningful benchmark for financial security. |

The Result:

To achieve a final corpus equivalent to ₹1 Crore today, an individual starting at age 20 with the assumptions above needs to invest a Systematic Investment Plan (SIP) of only ₹2,000 per month.

This revelation is the most powerful takeaway for anyone in their 20s. A financial goal that sounds achievable (₹1 Crore) is achieved with a monthly commitment that is highly manageable. This SIP, consistently applied over 45 years, will grow to a nominal value of approximately ₹3.5 Crore by age 65 (assuming 5% inflation), which is the inflation-adjusted equivalent of ₹1 Crore today.

Rs. 2000 SIP Returns Calculation Video

Watch more Videos on YouTube Channel

The True Cost of Delay: A Quantitative Analysis

The power of this SIP is brutally exposed when the starting age is delayed. This highlights the non-linear relationship between time and money.

| Starting Age | Investment Duration | Monthly SIP Required (to reach ₹1 Cr) | Financial Impact (Cost of Delay) |

| 20 | 45 Years | ₹2,000 | The Baseline: Maximum Efficiency |

| 30 | 35 Years | ₹5,000 | A 10-Year Delay More Than Doubles the required monthly investment. |

| 40 | 25 Years | ₹12,000 | A 20-Year Delay requires a Six-Fold Increase in monthly commitment. |

| 50 | 15 Years | ₹40,000+ | A 30-Year Delay makes the goal practically impossible for most income levels. |

This comparison table provides a stark, irrefutable mathematical truth: Delaying is exponentially expensive. The cost of delay is a six-fold increase in monthly effort for a mere 20-year postponement. Your ₹2,000 SIP today is the most efficient money you will ever invest.

Strategic Asset Allocation: Building a High-Growth Investment Portfolio for Your 20s

With a long time horizon and high risk-taking capacity, a young investor should prioritize growth over protection. This necessitates a heavily skewed portfolio towards high-yielding, volatile assets. The aggressive allocation model specifically designed for the risk appetite and time horizon of a person in their 20s.

The Recommended Aggressive Portfolio for the 20s

| Asset Class | Allocation Percentage | Rationale | Recommended Instrument |

| Equity (Stocks/Mutual Funds) | 70% | Highest growth potential; best inflation-beating asset over 10+ years. | Smallcase, Low-Cost Index Funds, Mid/Small-Cap Funds |

| Gold | 15% | Acts as a hedge against inflation and equity market downturns; store of value. | Sovereign Gold Bonds (SGBs), Gold ETFs |

| Cryptocurrency (Optional) | 10% | Very high-risk, high-return, highly volatile asset; suitable for high-risk allocation in the 20s. | Bitcoin, Ethereum |

| Cash/Fixed Deposits (Safety) | 5% | For liquidity and emergency fund requirements. | Fixed Deposits (FDs), Liquid Funds |

| Total | 100% |

Why Equity Outperforms FDs, and the Smart Way to Own Gold

A deeper understanding of why certain investment vehicles are preferred over others is essential for maintaining conviction during market downturns. The difference between an asset for ‘Protection’ and an asset for ‘Growth’ must be understood.

Equity vs. Fixed Deposits Comparison

| Parameter | Fixed Deposits (FDs) | Equity (Stocks/Mutual Funds) | Conclusion for a 20-Year-Old |

| Primary Purpose | Safety/Protection of Capital | Long-Term Growth/Wealth Creation | Growth is the Priority |

| Liquidity | Low (penalties for early withdrawal) | High (can be sold instantly) | Advantage: Equity |

| Risk Profile | Very Low | High (Volatile, but risk diminishes over 15+ years) | High Risk is Acceptable |

| Typical Return | Low (4-6% Gross) | High (10-14% Average Long-Term) | Higher Return is Necessary |

| Inflation-Adjusted Return | Often Negative or near Zero | Positive and Substantial | FDs are Destructive to Long-Term Wealth |

| Taxation | Interest Taxable at Slab Rate | Long-Term Capital Gains are more tax-efficient | Equity is Tax-Advantaged |

The choice is unambiguous: for a long-term goal like retirement, FDs should be viewed as financial anchors that prevent wealth creation. Only money needed in the short term (under 3 years) belongs in an FD.

The Superiority of Sovereign Gold Bonds (SGBs)

The way one holds gold determines its true return.

| Investment Vehicle | Benefits | Drawbacks | Net Value Proposition |

| Physical Gold (Jewelry) | Sentimental value; always accessible. | Making charges (10-25%); storage risk; no interest; low liquidity; high lock-in. | Worst investment; high friction. |

| Gold ETFs | Tracks gold price closely; highly liquid; no storage/purity issues. | Small Expense Ratio (Fee); no interest payment. | Good option; highly liquid. |

| Sovereign Gold Bonds (SGBs) | Tracks gold price; pays 2.5% fixed annual interest; no storage risk; tax-efficient. | Lower liquidity (8-year maturity); not a trading instrument. | Best option for long-term gold exposure. |

The decision is to swap a non-productive, depreciating asset (jewelry) for a paper asset (SGBs) that pays you interest simply for holding it.

Frequently Asked Questions

Q1: I’m currently a student with only a small allowance. Is it worth starting an SIP of just ₹500 or ₹1,000?

A1: Yes, absolutely. The most valuable thing you are investing right now is time. An SIP of ₹500 today is vastly superior to a ₹5,000 SIP starting five years from now. You are building the discipline of investing and capturing those early years of compounding, which are disproportionately important for your final corpus. The goal is to start, not to start big.

Q2: Should I pay off my Education Loan before starting my investments?

A2: This is the only acceptable high-interest debt that can be managed alongside investing. A common strategy is to invest more than the interest rate of the loan. If your loan is 8%, and your expected equity return is 12%, you can invest simultaneously. However, you should still prioritize aggressive repayment, especially if the loan is above 10%, while maintaining your minimum SIP commitment. For other loans (personal, credit card, car), always pay them off first.

Q3: The suggested portfolio is 70% in Equity. Isn’t that too risky for a beginner?

A3: For a young person in their 20s, a 70% equity allocation is appropriate because your time horizon (40+ years) is the ultimate risk mitigator. While the market will definitely crash multiple times over four decades, history shows that it always recovers and hits new highs. You have the time to ride out the volatility and benefit from the high long-term returns of equity. A lower allocation (e.g., 40-50%) is too conservative and will hinder your wealth growth.

Q4: How should I manage the 5% Cash/Safety allocation? Should I keep it in a savings account?

A4: The 5% should represent 6-12 months of your essential living expenses and should be kept in highly liquid, capital-protected instruments. The best places are high-yield Fixed Deposits (FDs), Liquid Mutual Funds, or Ultra Short Duration Funds. A standard savings account is too inefficient due to its low-interest rate.

Q5: Is it better to pick individual stocks or invest in Mutual Funds/Smallcases?

A5: For 95% of investors, professional management is superior.

- Mutual Funds (Index Funds): Best for passive investors. They track a large index and require zero effort after the initial investment.

- Smallcase: A powerful intermediate option. It allows you to own a ready-made, professionally researched portfolio of stocks with a specific theme. This is an excellent way to get direct stock exposure without the heavy lifting of stock picking. Unless you are an expert and can dedicate significant time to research, stick to Mutual Funds or Smallcase.

Q6: What is the risk of investing 10% in Crypto, and is it mandatory?

A6: It is totally optional and should be considered speculative. The risk is a potential total loss of that 10% allocation. Cryptocurrencies have no historical data and are extremely volatile. However, given the long time horizon, a small allocation can be considered a high-risk, high-reward bet on the future of decentralized finance. Only invest money you are entirely prepared to lose.

Conclusion

Your 20s are a period of unprecedented financial leverage. The combination of your long time horizon and the compounding effect transforms small, consistent actions into massive, future wealth. The choice is yours: will you allow lifestyle inflation and high-interest debt to steal your future, or will you embrace the discipline of the ₹2,000 SIP and the 20% investment rule to secure it?

The comprehensive plan outlined here is not merely a set of suggestions; it is a formula for financial freedom:

- Eliminate bad debt and secure an adequate insurance shield.

- Live below your means and make 20%+ investment a non-negotiable priority.

- Start your SIP today, leveraging the power of time.

- Allocate aggressively (70% Equity) to outpace inflation.

- Avoid FDs for long-term goals; they are for protection only.

Remember, your financial trajectory is not determined by the size of your first paycheck, but by the discipline you establish today. Every single day of delay is costing you millions of rupees in forgone compounding. Take charge of your 20s, invest intelligently, and build your ₹1 Crore fortress one disciplined month at a time. The future you is waiting to thank you for the choices you make right now.