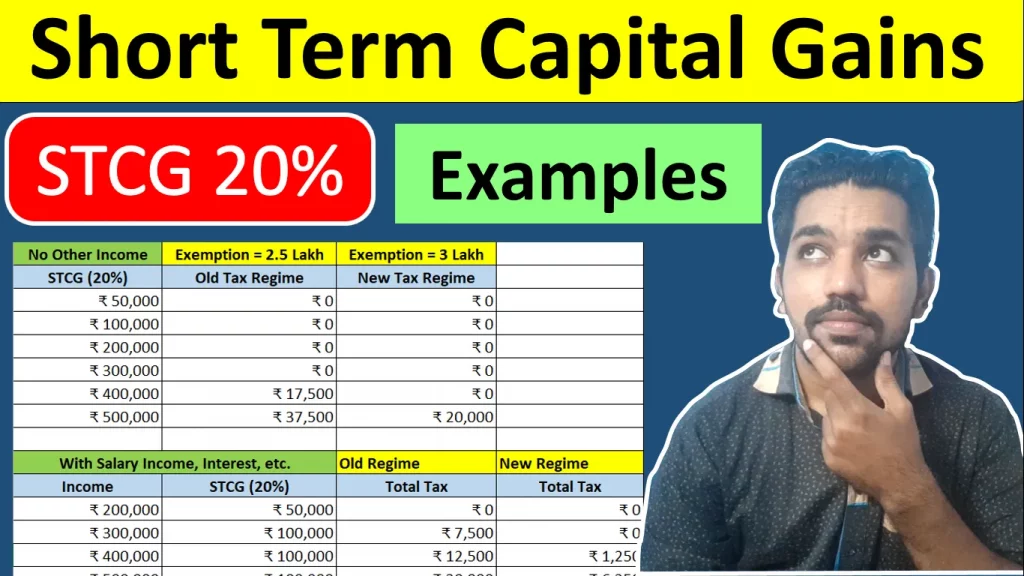

In this article we will discuss about taxation on short term capital gains with the help of examples. We will see different examples on Taxation on short term capital gains, adjustment of short term capital gains against basic exemption limit and whether you can claim deduction on short term capital gains.

Short term capital gains is a type of capital gains that arises when we sell shares or equity mutual funds within 12 months from the date of purchasing them. Taxation on short term capital gains is very simple based on your total income and STCG tax rate is 20% on the gains you have made. But you can also adjust STCG against your income if you fall below taxable income bracket. When STCG belongs to Section 111A, you will not be able to claim deductions under Sections 80C to 80U.

We will understand all this with the help of examples.

- Short Term Capital Gains Tax Calculation Video

- What is Capital Gains

- What is Short Term Capital Gains

- STCG covered under section 111A

- STCG other than covered under section 111A

- Short Term Capital Gains Tax Rate

- Taxation on Short Term Capital Gains

- Basic Exemption limits in Income

- Adjustment of STCG against Basic Exemption Limit

- Deductions under section 80C to 80U and STCG

Short Term Capital Gains Tax Calculation Video

Watch more Videos on YouTube Channel

What is Capital Gains

Profits or gains arising from transfer of a capital asset are called “Capital Gains” and are charged to tax under the head “Capital Gains”.

Example: When you sell shares or equity mutual funds and you make profits after selling these units, it is called capital gains. Also, when you buy land and sell it to make profits, it is called capital gains. When you make losses while selling such assets, it is called capital loss.

What is Short Term Capital Gains

Any capital asset held by the taxpayer for a period of not more than 36 months immediately preceding the date of its transfer will be treated as short-term capital asset.

For shares of companies or equity mutual funds the period is 12 months. So shares or equity mutual funds sold within 12 months from the date of purchasing and making profits on such selling will be termed as Short Term Capital Gains.

To make it simple we will talk about STCG on shares or equity mutual funds in this article to understand the examples more clearly.

STCG covered under section 111A

STCG are classified as follows :

- Short term capital gains covered under section 111A.

- Short term capital gains other than covered under section 111A.

Examples of STCG covered under section 111A:

- STCG arising on sale of equity shares

- STCG arising on sale of units of equity oriented mutual fund sold through a recognized stock exchange which is chargeable to STT

- Short term capital gains arising on sale of units of a business trust

- STCG arising on sale of equity shares, units of equity oriented mutual fund or units of a business trust through a recognized stock exchange located in any International Financial Services Centre and consideration is paid or payable in foreign currency even if transaction of sale is not chargeable to securities transaction tax (STT).

STCG other than covered under section 111A

Examples of STCG not covered under section 111A:

- STCG arising on sale of equity shares other than through a recognized stock exchange

- STCG arising on sale of shares other than equity shares

- Short term capital gains arising on sale of units of non-equity oriented mutual fund (debt oriented mutual funds).

- STCG on debentures, bonds and Government securities.

- STCG on sale of assets other than shares/units like STCG on sale of immovable property, gold, silver, etc

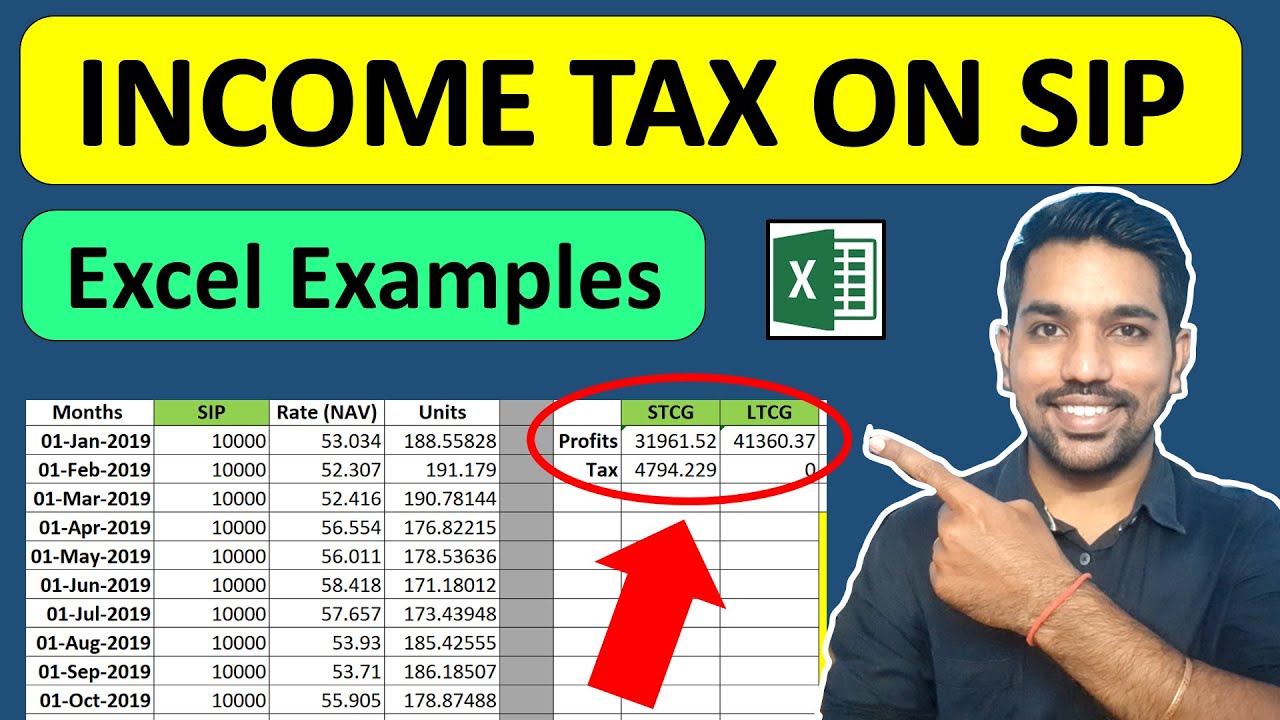

Watch below video to understand Income Tax on SIP:

Short Term Capital Gains Tax Rate

STCG covered under section 111A is charged to tax @ 20% (plus surcharge and cess as applicable).

Normal STCG, i.e., STCG other than covered under section 111A is charged to tax at normal rate of tax which is determined on the basis of the total taxable income of the taxpayer.

So taxation on short term capital gains will be calculated based on your income and eligibility of your asset with respect to Section 111A which we have seen above.

Taxation on Short Term Capital Gains

Let us understand taxation on short term capital gains with an example below:

Example

Question. Mr. Prakash (resident and age 40 years) is a salaried employee working in SM Ltd. at an annual salary of Rs. 8,40,000. In December, 2023 he purchased 10,000 equity shares of A Ltd. at Rs. 100 per share and sold the same in April, 2024 at Rs. 125 per share (brokerage Re. 1 per share). The shares were sold through Bombay Stock Exchange and securities transaction tax was paid by Mr. Ashok. What will be the tax liability of Mr. Ashok?

Ans. STCG is covered under section 111A and, hence, will be charged to tax @ 20%. Salary income being normal income will be charged to tax at normal rate. The normal tax rates for the financial year 2024-25 applicable to resident an individual below the age of 60 years are as follows: (based on Old Tax Regime)

- Nil up to income of Rs. 2,50,000

- 5% for income above Rs. 2,50,000 but up to Rs. 5,00,000

- 20% for income above Rs. 5,00,000 but up to Rs. 10,00,000

- 30% for income above Rs. 10,00,000. Apart from above, health & education cess @ 4% will be levied on the amount of tax.

Based on Income Tax Calculator, income tax on salary income will be Rs. 73,320 (old Tax Regime).

Shares purchased with amount = Rs. 10,00,000 (10,000 equity shares * Rs. 100 per unit) and sold at Rs. 12,50,000 (10,000 equity shares * Rs. 125 per unit), but brokerage paid is Rs. 10,000 (Rs. 1 per unit * 10,000 equity shares), which makes total STCG = Rs. 2,40,000 (12,50,000 – 10,00,000 – 10,000).

Now taxation on short term capital gains will be @ 20%, which is Rs. 48,000 + required cess amount.

Basic Exemption limits in Income

Basic exemption limit means the level of income up to which a person is not required to pay any tax. The basic exemption limit applicable in case of an individual for the financial year 2024-25 is as follows:

- For resident individual of the age of 80 years or above, the exemption limit is Rs. 5,00,000.

- For resident individual of the age of 60 years or above but below 80 years, the exemption limit is Rs. 3,00,000.

- For resident individual of the age below 60 years, the exemption limit is Rs. 2,50,000.

- For non-resident individual irrespective of the age of the individual, the exemption limit is Rs. 2,50,000.

- For HUF, the exemption limit is Rs. 2,50,000.

Use below calculator to calculate your income tax for FY 2024-25:

Example 1

Question: Mr. Gupta (resident, age 25 years) is a salaried employee earning taxable salary of Rs. 1,84,000 per annum. Apart from salary income he has earned interest on fixed deposit of Rs. 6,000. He does not have any other income. What will be his tax liability for the year 2023-24?

Ans. For resident individual of the age below 60 years, the basic exemption limit is Rs. 2,50,000. In this case, the taxable income of Mr. Kapoor is Rs. 1,90,000 (Rs. 1,84,000 + Rs. 6,000), which is below the basic exemption limit of Rs. 2,50,000, hence, his tax liability will be NIL.

Example 2

Question. Mr. Sawant (resident and age 62 years) is a businessman. His taxable income for the year 2023-24 is Rs. 2,75,200. He does not have any other income. What will be his tax liability for the year 2023-24?

Ans. For resident individual of the age of 60 years and above but below 80 years, the basic exemption limit is Rs. 3,00,000. In this case, the taxable income of Mr. Viren is Rs. 2,75,200, which is below the basic exemption limit of Rs. 3,00,000, hence, his tax liability will be NIL.

ALSO READ: Income Tax Calculation FY 2024-25 using Excel

Adjustment of STCG against Basic Exemption Limit

Only a resident individual and resident HUF can adjust the exemption limit against STCG covered under section 111A. Thus, a non-resident individual/HUF cannot adjust the exemption limit against STCG covered under section 111A.

A resident individual/HUF can adjust the STCG covered under section 111A against the basic exemption limit but such adjustment is possible only after making adjustment of other income. In other words, first income other than STCG covered under section 111A is to be adjusted against the exemption limit and then the remaining limit (if any) can be adjusted against STCG covered under section 111A.

Example 1

Question. Mr. Thakur (age 21 years and resident) purchased equity shares of SBI Ltd. in March, 2023 and sold the same in May, 2023 (sold in Bombay Stock Exchange and STT is levied). Taxable STCG amounted to Rs. 1,20,000. Apart from gain on sale of shares he is not having any income. What will be his tax liability for the year 2023-24?

Ans. For resident individual of the age below 60 years, the basic exemption limit is Rs. 2,50,000. Further, a resident individual can adjust the basic exemption limit against STCG covered under section 111A. In this case, STCG of Rs. 1,20,000 is covered under section 111A, hence, the adjustment of such gain against the exemption limit is allowed only to a resident. In this case, Mr. Kapoor is a resident and, hence, he can adjust the STCG of Rs. 1,20,000 against the exemption limit.

Considering the above discussion, the tax liability of Mr. Kapoor for the year 2023-24 will be NIL.

Example 2

Question. Mr. Krunal (age 59 years equity and resident) is a retired person earning a monthly pension of Rs. 5,000. He purchased shares of SBI Ltd. in December, 2022 and sold the same in April, 2023 (sold in Bombay Stock Exchange and STT is levied). Taxable STCG amounted to Rs. 2,20,000. Apart from pension income and gain on sale of shares he is not having any other income. What will be his tax liability for the year 2023-24?

Ans. The basic exemption limit in this case is Rs. 2,50,000, after adjustment of pension income of Rs. 60,000 from the exemption limit of Rs. 2,50,000 the balance will come to Rs. 1,90,000. The balance of Rs. 1,90,000 will be adjusted against STCG. Total STCG on sale of shares is Rs. 2,20,000 and the available exemption limit (after adjustment of pension income) is Rs. 1,90,000, hence, the balance STCG left after adjustment of Rs. 1,90,000 will come to Rs. 30,000. The gain of Rs. 30,000 will be charged to tax @ 15% (plus cess @ 4%). STCG tax rate is increased to 20% in FY 2024-25.

Thus, the tax liability before cess will come to Rs. 4,500. Since the total income of Mr Krunal is up to Rs. 5,00,000, he shall be eligible for rebate available under section 87A. Rebate shall be limited to tax payable or Rs. 12,500, whichever is less.

Deductions under section 80C to 80U and STCG

No deduction under sections 80C to 80U is allowed on short-term capital gains referred to in section 111A. However, such deductions can be claimed from STCG other than covered under section 111A.

Some more Videos

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Some more reading

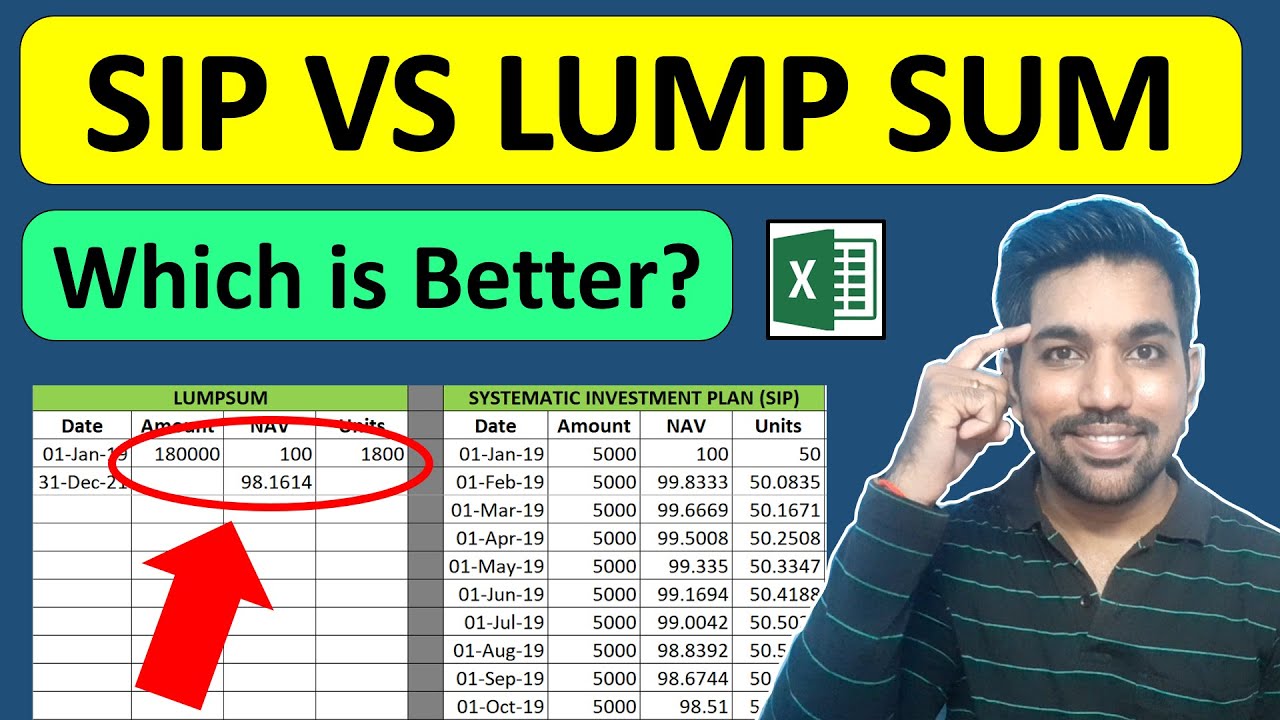

- SIP Return Excel Calculation

- SWP Calculation using Excel (Systematic Withdrawal Plan)

- How compounding works in SIP

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.