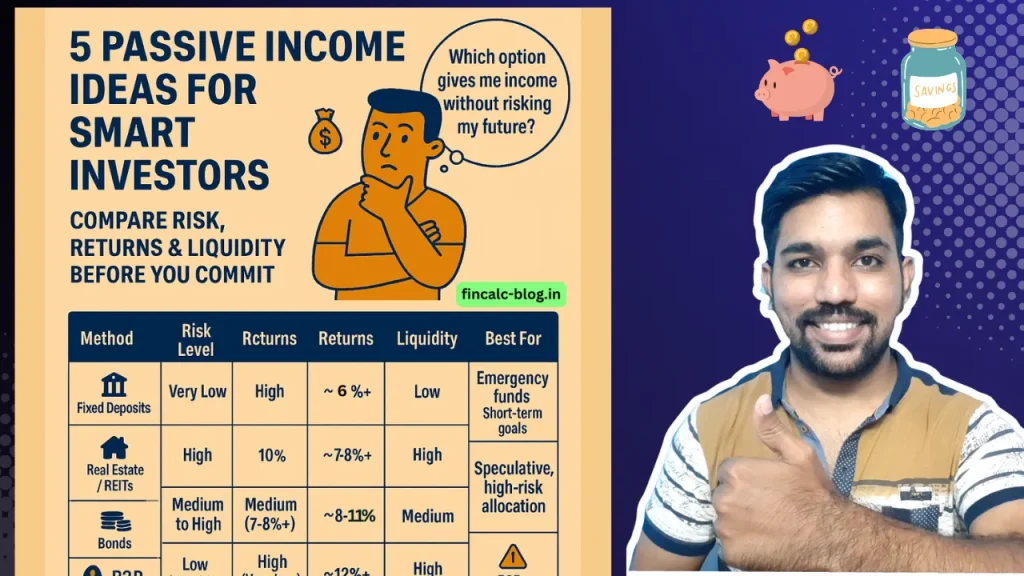

5 Ways to Generate Passive Income from Your Investments

5 ways to generate passive income includes Fixed Deposit Interests, SWP for monthly income from mutual funds, Real Estate, buying bonds and P2P lending

5 Ways to Generate Passive Income from Your Investments Read More »