3 Steps to get ₹2.5 Lakh Monthly Passive Income | SIP + SWP [VIDEO]

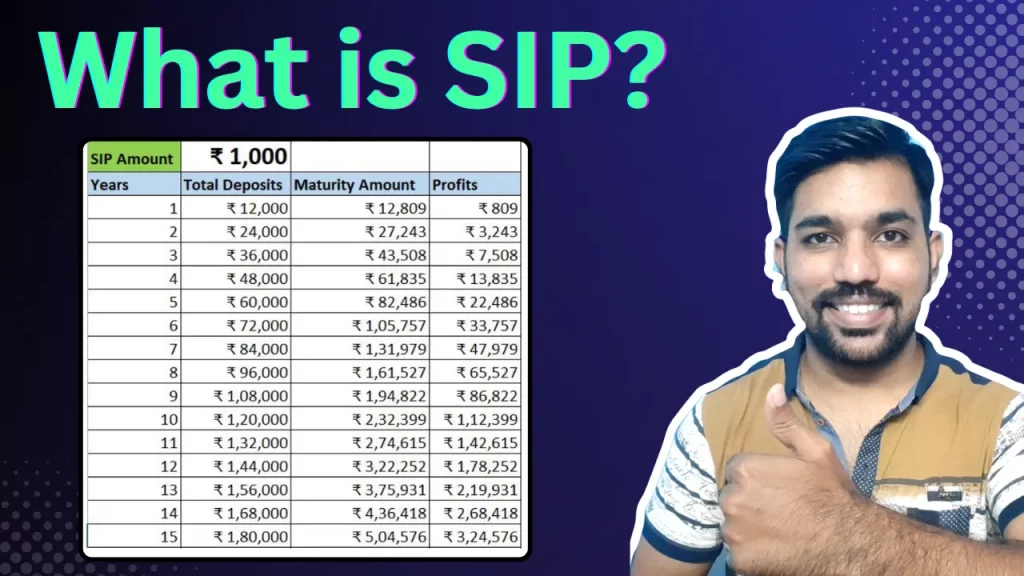

Steps to get ₹2.5 Lakh Monthly Passive Income.. 1. Using SIP to accumulate 10 Lakh 2. Maintain the amount for compounding benefit 3. Using SWP for monthly income..

3 Steps to get ₹2.5 Lakh Monthly Passive Income | SIP + SWP [VIDEO] Read More »