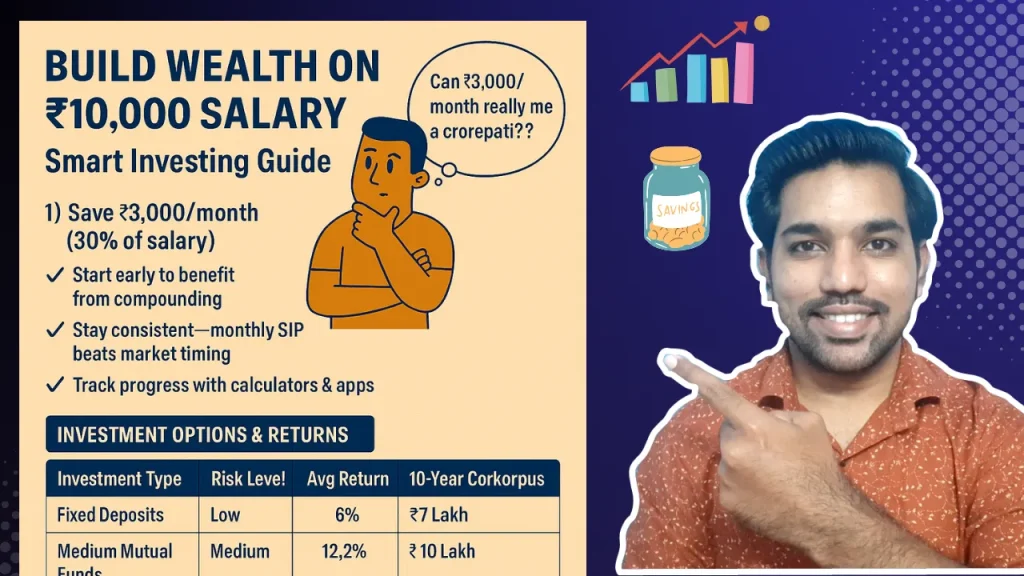

How to Build Wealth on a ₹10,000 Salary: Smart Investing Guide

How to Build Wealth on Salary.. You have multiple options including investing in yourself, Fixed Deposits, Conservative Mutual Funds, Aggressive Mutual Funds..

How to Build Wealth on a ₹10,000 Salary: Smart Investing Guide Read More »