How To Calculate Income Tax FY 2022-23 [Salary Example]

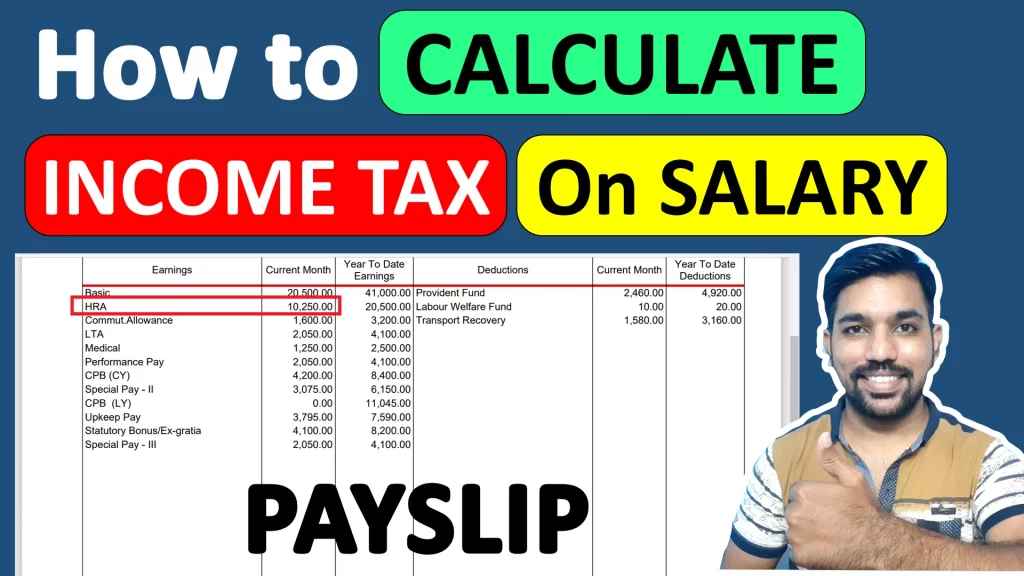

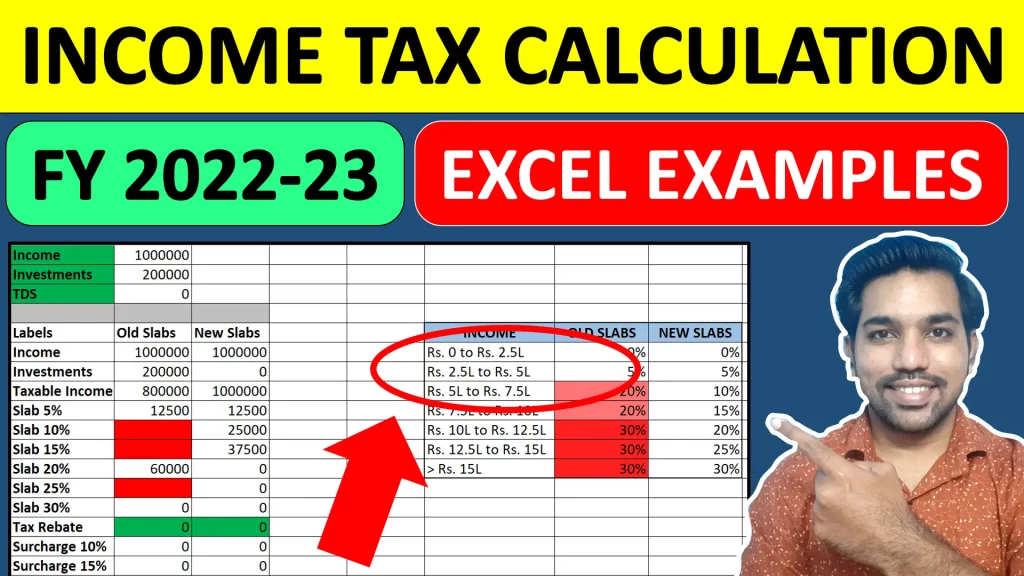

How to Calculate Income Tax FY 2022-23 steps – Calculate your Taxable Income, Identify your Tax Bracket, Choose between Old and New Tax Regime..

How To Calculate Income Tax FY 2022-23 [Salary Example] Read More »