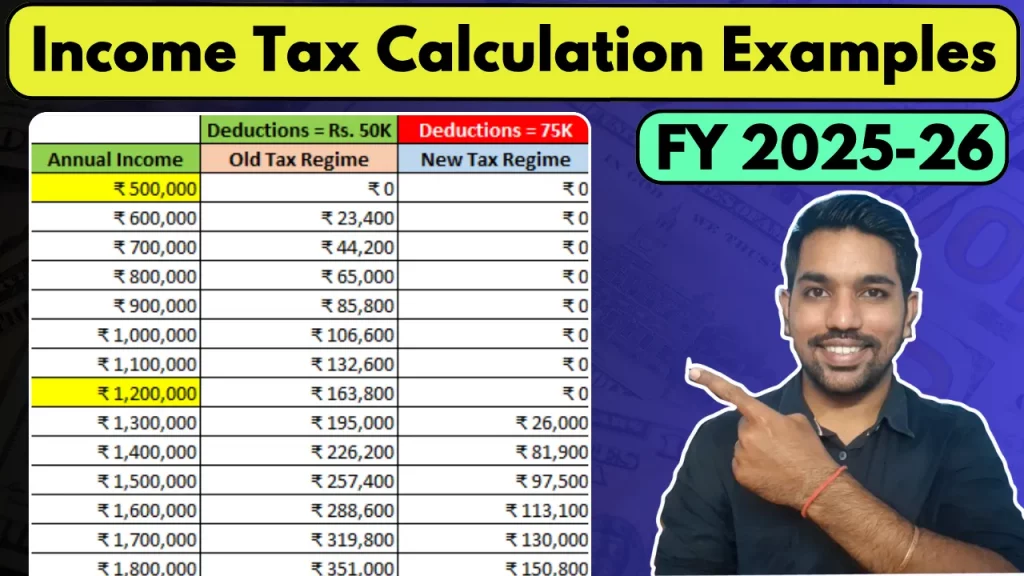

Why Tax of Rs. 26,000 on 13 Lakh Income in New Tax Regime? [Video]

You need to pay tax of Rs. 26,000 on 13 lakh income with new tax regime in FY 2025-26, instead of Rs. 66,300, due to marginal relief benefit. Based on marginal relief under Section 87A, if your income is slightly above Rs. 12.75 lakh in FY 2025-26, you only have to pay the amount that […]

Why Tax of Rs. 26,000 on 13 Lakh Income in New Tax Regime? [Video] Read More »