7 Benefits of Senior Citizen Saving Scheme (SCSS) with Calculator

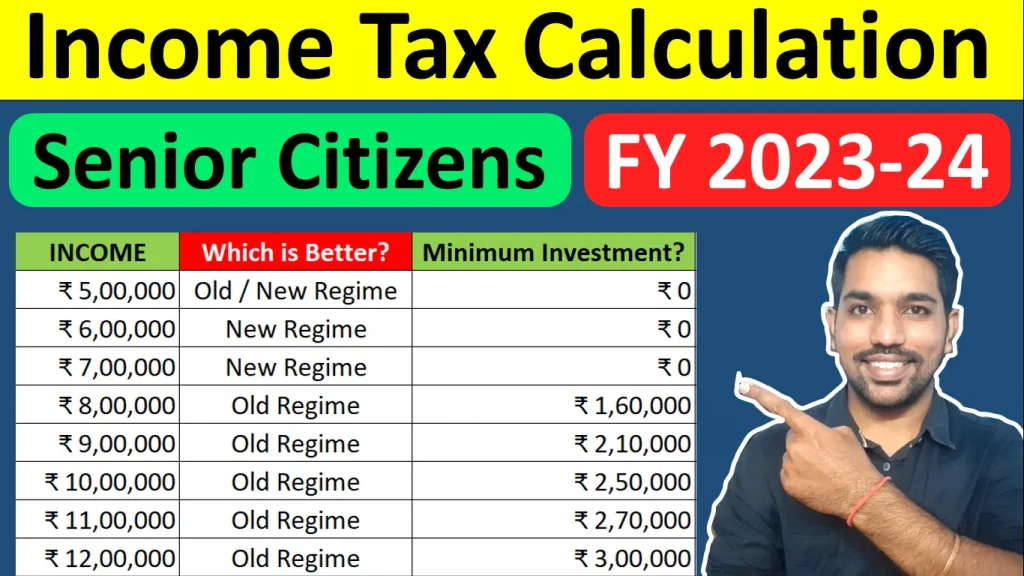

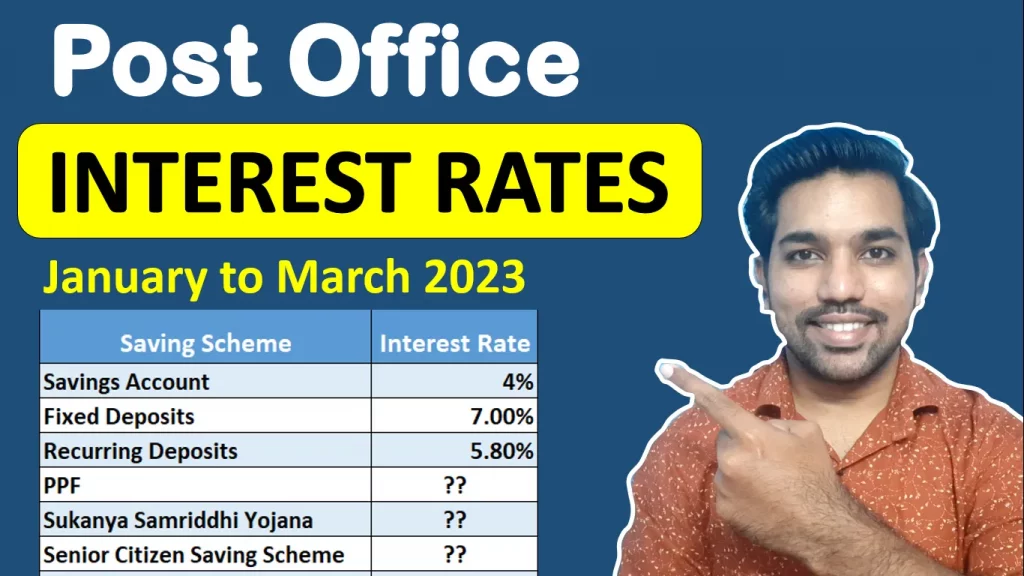

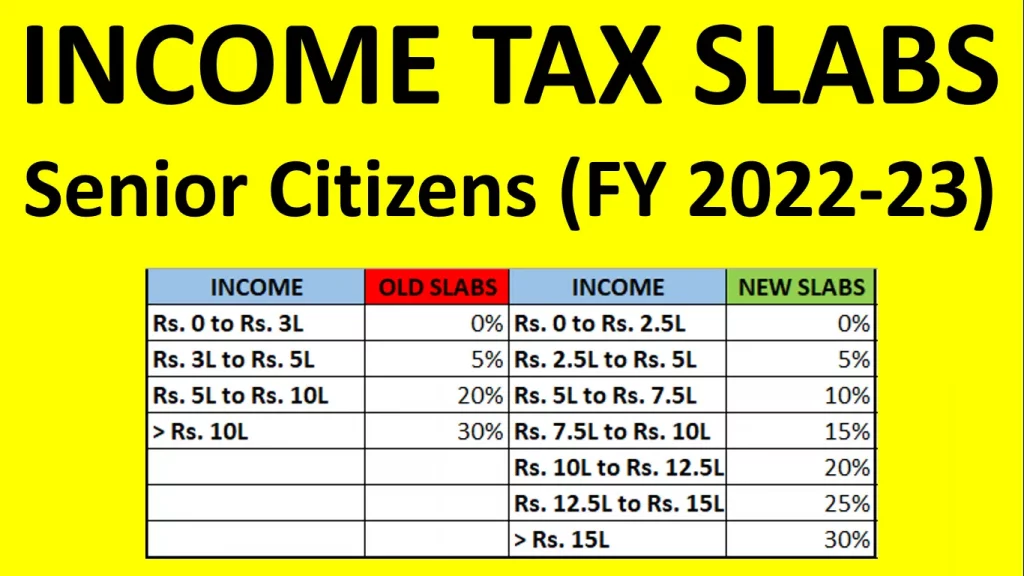

Benefits of Senior Citizen Saving Scheme. 1. High Interest Rate 2. Government Backed 3. Tax Saving Benefits 4. Flexible Investment 5. Quarterly Payments

7 Benefits of Senior Citizen Saving Scheme (SCSS) with Calculator Read More »