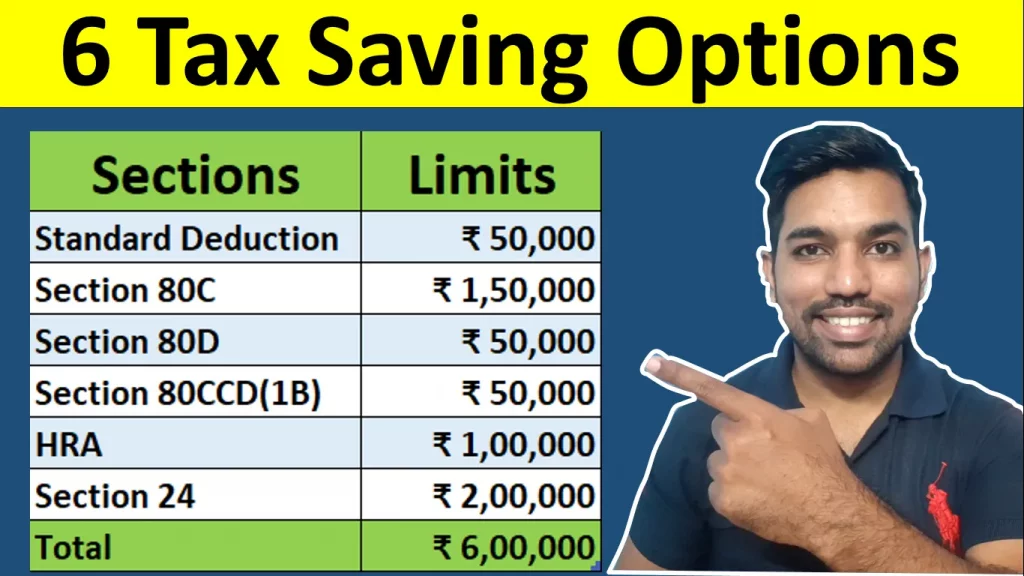

6 Tax Saving Tips using Old Tax Regime | Save Income Tax

Save Income Tax options: 1. Standard Deduction 2. Section 80C 3. Section 80D 4. Section 80CCD(1B) 5. HRA (House Rent Allowance) to save income tax..

6 Tax Saving Tips using Old Tax Regime | Save Income Tax Read More »