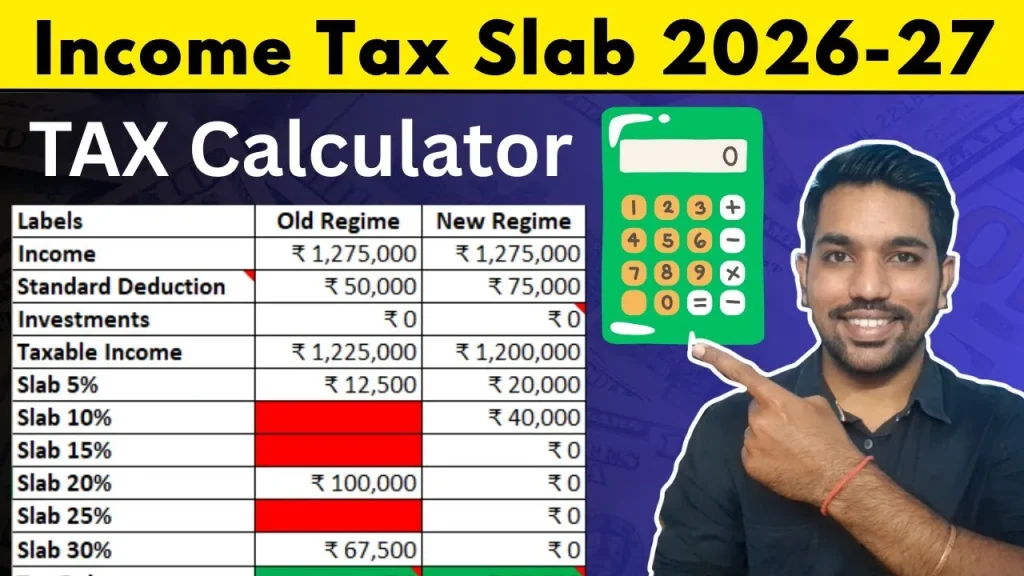

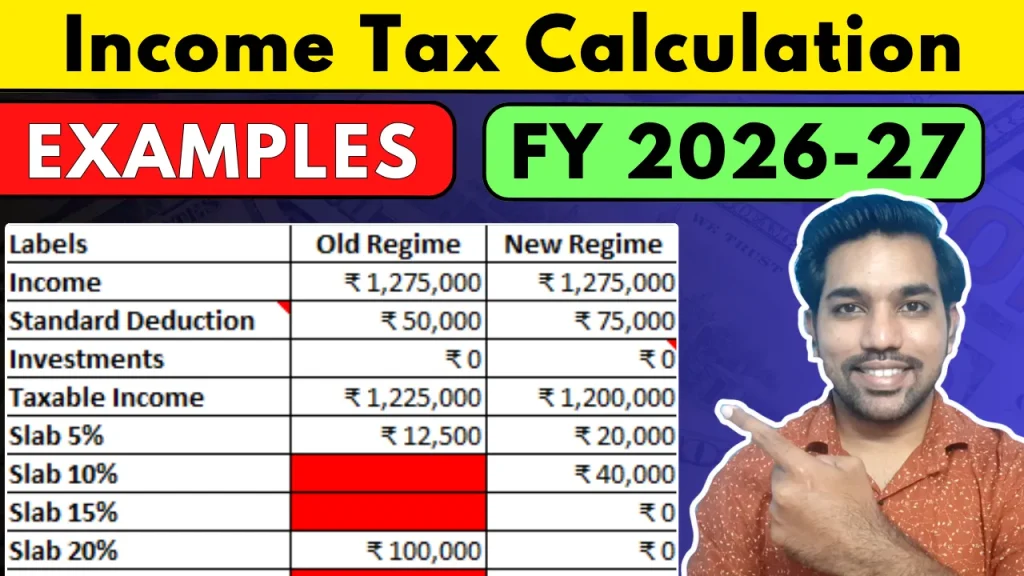

Income Tax Slab Rates FY 2026-27 – Old vs New Tax Regime

Income Tax Slab Rates FY 2026-27.. ZERO tax on income up to 12 lakh in 2026-27 with new tax regime. Tax Rebate of Rs. 60,000 in new regime for 2026-27..

Income Tax Slab Rates FY 2026-27 – Old vs New Tax Regime Read More »