What is Form 16 in Income Tax Return? How to Download & Meaning

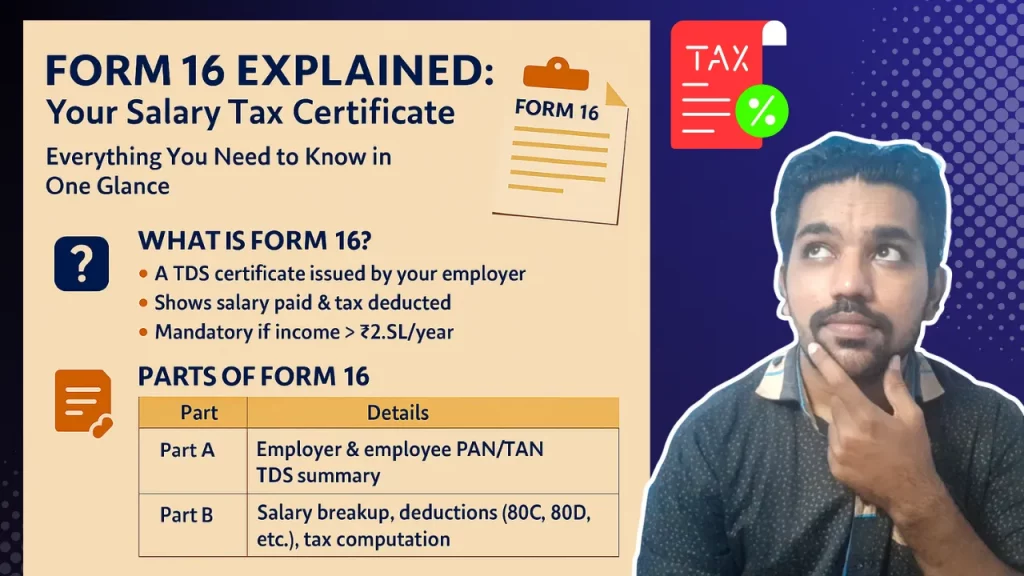

What is Form 16 in Income Tax Return? Form 16 is a document that helps you understand the total income earned by you, Tax Deducted by employer and investments mentioned by you

What is Form 16 in Income Tax Return? How to Download & Meaning Read More »